1.0 Market Overview: The Evolution from Growth to Maturity

The Seongsu commercial district has cemented its position as one of Seoul’s most strategically important retail markets. Previously identified as an emerging district in a high-growth phase, Seongsu has rapidly transitioned into a mature market. This evolution, accelerated in the post-pandemic era, is characterized by the strategic entry of major domestic and international retail brands, a corresponding rise in rental values, and a consistent decline in commercial vacancy rates. This analysis provides an in-depth assessment of the metrics and trends defining Seongsu’s current market strength and its promising future trajectory for potential investors.

The district’s maturation is distinguished by a unique ability to integrate large-scale commercial operations without sacrificing its foundational identity. This balance is key to its sustained appeal and long-term value.

“In the past year, the Seongsu commercial district has rapidly expanded its commercial scale and influence, centered on Dong- and Seo-yeonmujang-gil, with the entry of flagship stores from global fashion brands such as Adidas and MLB. At the same time, individual shops and small cafes still hold their ground in the back alleys, maintaining Seongsu’s unique ‘hip’ atmosphere through coexistence with major brands. Amid these changes, Seongsu is further strengthening its appeal as a commercial district through the combination of residential and office spaces and the active inflow of content. This popularity is expected to continue for the foreseeable future.”

— Nam Shin-gu, Director, Retail Tenant Advisory Team.

This expert assessment underscores the district’s multifaceted appeal, which is quantitatively substantiated by powerful trends in visitor traffic and commercial engagement.

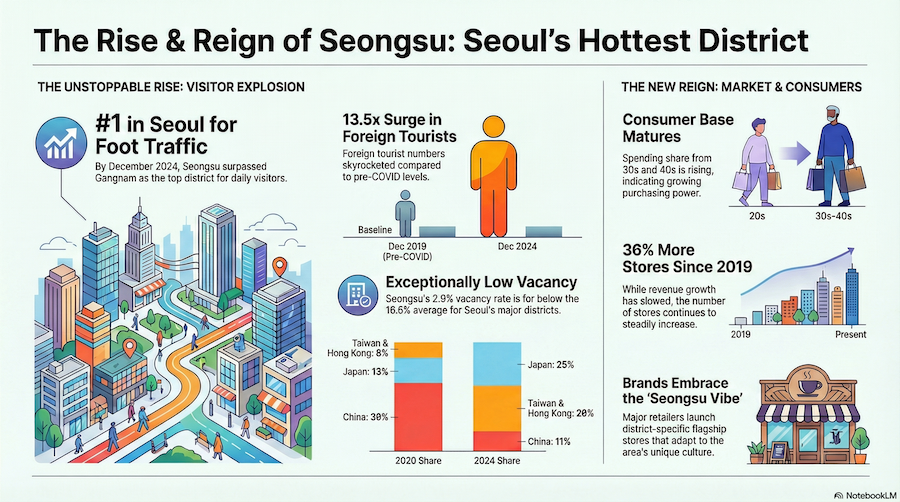

2.0 Visitor & Foot Traffic Analysis: Quantifying Market Dominance

Visitor and foot traffic data serve as primary indicators of a commercial district’s vitality, consumer demand, and overall investment appeal. In this regard, Seongsu has not only demonstrated robust health but has also emerged as a market leader, attracting an unprecedented volume of both domestic and international visitors.

2.1 Foot Traffic Leadership

Seongsu’s performance in attracting visitors has been exceptional, surpassing even the most established commercial hubs in Seoul.

- #1 in Daily Foot Traffic: As of December 2024, Seongsu’s daily average foot traffic surpassed that of the Gangnam district, achieving the number one rank among Seoul’s major commercial areas.

- Top-Tier Visitor Density: The district’s foot traffic density, measured per unit area, ranked 5th, indicating an extremely high concentration of visitors and commercial activity within its core streets.

2.2 International Tourism Surge

The district has become a primary destination for foreign tourists, with growth rates far exceeding pre-pandemic levels. The number of foreign tourists visiting Seongsu in December 2024 was approximately 13.5 times higher than in December 2019. This surge has been accompanied by a significant shift in the demographic composition of these international visitors.

| Nationality | Change in Visitor Share (2020 vs. 2024) |

| Japan | Significantly Increased |

| Taiwan | Significantly Increased |

| Hong Kong | Significantly Increased |

| China | Greatly Decreased |

| United States | Greatly Decreased |

2.3 Vacancy Rate Analysis

Seongsu’s high desirability is directly reflected in its exceptionally low commercial vacancy rate, which stands in stark contrast to the broader Seoul market. At the end of 2024, Seongsu’s vacancy rate was a mere 2.9%. This is a powerful testament to tenant demand, especially when compared to the 16.6% average vacancy rate recorded across other major Seoul commercial districts during the same period. This extreme tenant demand places significant upward pressure on rental values, reinforcing the district’s premium market status.

The combination of dominant foot traffic, a booming international presence, and near-full occupancy rates directly correlates with the district’s strong economic performance and future growth potential.

3.0 Economic Performance and Future Growth Catalysts

A thorough analysis of revenue trends and the future development pipeline is essential for assessing a market’s long-term financial viability and potential for capital appreciation. Seongsu demonstrates a stable economic base with significant catalysts poised to drive its next phase of expansion.

3.1 Revenue Trend Analysis

After a period of explosive growth, Seongsu’s overall sales revenue has entered a stabilization phase, exhibiting a “box pattern” that suggests a new, higher baseline of economic activity. While the initial hyper-growth has moderated, sector-specific trends reveal a dynamic and resilient market.

Revenue Trend by Sector (Year-over-Year Change)

| Sector | Dec 2022 -> Dec 2023 Change | Dec 2023 -> Dec 2024 Change |

| F&B | +15% | -6% |

| Service | +19% | +7% |

| Retail | -29% | 0% (stabilized) |

Notably, the Medical sector has demonstrated consistent revenue growth throughout the observation period, signaling a stable and expanding service base within the district.

3.2 Major Development Projects

Several large-scale development projects, led by major corporations, are set to significantly enhance Seongsu’s infrastructure and commercial offerings, acting as powerful catalysts for future growth.

- Buyoung Group: Development of a hotel on the prominent former E-Mart site.

- Sampyo Group: A transformative mixed-use development on the Sam표 Remicon factory site, planned to include a hotel, residences, retail, office space, and a complex cultural facility.

- Krafton: Development of a new corporate headquarters, which will further anchor the district as a hub for business and innovation.

The successful completion of these projects is expected to elevate the Seongsu commercial district to a new level of sophistication and economic power, broadening its appeal to residents, workers, and visitors alike.

This robust economic landscape is supported by a dynamic and growing composition of retailers who are investing in the district’s future.

4.0 Retail Landscape and Store Composition

The number and mix of retail stores are critical indicators of investor confidence and a district’s commercial identity. Seongsu’s retail landscape shows sustained growth and a dynamic evolution across key sectors, reflecting its increasing appeal to a wide range of businesses.

4.1 Overall Store Growth

The total number of stores in Seongsu has demonstrated a consistent upward trajectory, signaling strong and sustained business interest in the district. From September 2019 to December 2024, the total store count increased by approximately 36%.

4.2 Sector-Specific Store Trends

An analysis of store counts by sector reveals a strategic diversification of the district’s commercial offerings, with notable growth in high-value and experience-oriented categories.

Store Count Changes by Key Sector

| Sector | Trend Analysis (Dec 2022 – Dec 2024) | Strategic Implication |

| F&B | Maintains the highest number of stores, though a slight decrease was noted in Dec 2024. | Remains the anchor of the district, providing essential daily traffic and services. |

| Retail | Store count is consistently increasing. | Growth is driven by brand presence and marketing, as revenue has not grown proportionally. |

| Service & Medical | Both sectors show steady growth in store numbers. | This growth is directly supported by and anticipates the needs of the incoming residents and office workers from major developments like the Sampyo Group and Krafton HQ projects. |

| Entertainment | Experienced a massive 139% increase in stores from Dec 2022 to Dec 2023. | Reflects a post-pandemic rebound and demand for lifestyle and leisure activities. |

| Hospitality | Showed a 200% increase in stores from Dec 2023 to Dec 2024. | Signals a strong recovery and readiness to accommodate increasing tourist numbers. |

This expanding and diversifying supply of retail and service establishments is a direct response to the evolving behaviors and preferences of the consumers who frequent the district.

5.0 Consumer Demographics and Spending Patterns

Understanding the evolving profile and behavior of a district’s consumers is fundamental to evaluating its long-term retail strategy and value proposition. Seongsu is currently experiencing a significant demographic shift, indicating an increase in the overall purchasing power of its visitor base and a change in consumption patterns.

5.1 Evolving Age Demographics

The primary consumer age group in Seongsu has recently shifted, signaling a maturation of its customer base.

- While consumers in their 20s became the dominant spending group in December 2023, their overall share decreased by December 2024.

- Concurrently, the spending proportion of consumers in their 30s and 40s increased in December 2024.

- This demographic evolution suggests a notable increase in the average purchasing power of visitors to Seongsu, attracting a more affluent and established clientele.

5.2 Shifting Consumption Times

Spending patterns throughout the day have also transformed, indicating an expansion of the district’s active commercial hours. While spending in December 2023 was highly concentrated in the afternoon and evening, this pattern reversed by December 2024. The most recent data shows a marked increase in consumer spending during late-night hours (22:00-01:00), suggesting a growing nightlife economy and extended visitor engagement.

This evolving consumer profile has created a fertile environment for a new wave of leading brands that are successfully capturing this market.

6.0 Brand Ecosystem and Market Leadership

The presence and performance of top-tier brands offer a clear window into a district’s commercial identity and competitive strength. In Seongsu, the brand ecosystem is characterized by strong growth from market leaders, a strategic balancing of its core retail pillars, and increasing upward pressure on prime retail rents.

6.1 Performance of Top Brands

The district’s leading brands are thriving, with the total revenue of the Top 10 brands in Seongsu growing by approximately 34% in December 2024 compared to the previous year. This growth has been accompanied by the entry of new, high-impact players into the top ranks, including Olive Young N Seongsu, Musinsa Store Seongsu, KITH, and Hanjeongseon.

6.2 Dominance of F&B and Retail

The composition of Seongsu’s top-performing brands has evolved, shifting from a market heavily dominated by F&B to a more balanced “two-pillar” system co-led by Retail.

- 2022: F&B (65% of Top 20), Retail (20% of Top 20)

- 2024: F&B (45% of Top 20), Retail (40% of Top 20)

This rebalancing indicates a maturation of the market, with high-fashion and lifestyle retail now sharing the spotlight with the district’s renowned food and beverage scene.

6.3 The “Seongsu-Specific” Brand Strategy

A key trend defining Seongsu’s unique market character is the move by major brands to open “Seongsu-specific” stores. Rather than deploying standardized formats, these brands are creating bespoke flagships that integrate with the local culture. A prime example is the Adidas Originals Flagship Seongsu, which was designed to reflect the neighborhood’s identity and offers exclusive collections available only at that location. This focus on creating unique flagship experiences explains the trend of rising store counts without proportional sales growth, indicating that for many top-tier brands, a Seongsu presence is a strategic marketing investment in brand identity rather than a pure sales-volume play. This strategy differentiates Seongsu’s maturation from the homogenization often seen in other major commercial districts, as large brands are choosing to adapt to Seongsu’s identity rather than overwrite it.

These findings culminate in a highly positive and durable investment outlook for the district.

7.0 Investment Outlook: The Reign of an Irreplaceable District

The Seongsu commercial district has successfully navigated the transition from a high-growth market to a mature and stable commercial powerhouse. This evolution was fueled by an explosion of domestic and international demand that has solidified its top-tier status in Seoul’s competitive retail landscape.

Crucially, unlike other mature districts that risk commercial homogenization, Seongsu is charting a different and more sustainable course. The emergent trend of major global brands creating unique, localized flagship stores allows them to capture the market’s energy while respecting its character. This symbiotic relationship—where large-scale retail coexists with the small, independent shops that preserve the district’s authentic “HIP” atmosphere—is the cornerstone of its enduring appeal.

This unique dynamic of coexistence and brand adaptation, combined with a robust pipeline of transformative future development—including the major projects led by Buyoung Group, Sampyo Group, and Krafton—solidifies Seongsu’s status as an irreplaceable commercial district. For investors, this translates to a durable and promising outlook, positioning Seongsu as a premier destination for long-term real estate investment.