1. 2025 Market Retrospective: A Year of Political and Regulatory Volatility

The Korean real estate market in 2025 was a year of stark contrasts, defined by a dramatic shift in momentum from the first half to the second. The year began under a cloud of political turmoil that gave way to a policy-driven rally, which in turn prompted a strong regulatory response. Understanding this two-act structure—a first half shaped by political crisis and a second half driven by a new government’s intervention—is essential for accurately forecasting the market’s trajectory into 2026.

1.1. First Half 2025: Political Uncertainty and a Tentative Recovery

The market entered 2025 in a state of paralysis. The aftershocks of an early-year declaration of martial law created significant political instability, fostering a widespread “wait-and-see sentiment” among buyers and sellers that led to a stagnant market.

A clear turning point emerged in March. As the political landscape stabilized following impeachment proceedings and the subsequent presidential election, market nerves calmed. This renewed stability was supercharged in Seoul by the temporary lifting of the ‘Land Transaction Permit Zone’ designation in several key areas. This regulatory relaxation was the first clear signal of a return to market normalcy, acting as a risk-repricing event that gave institutional and private capital the confidence to re-enter the market. The resulting surge in transactions and prices was not merely a release of pent-up demand, but a fundamental repricing of risk. This period was characterized by the interplay of Political Uncertainty, the stabilizing influence of the Presidential Election, and the direct market impact of Land Transaction Permit Zone regulations. This politically-driven, V-shaped recovery was so powerful that it created the very conditions—nascent overheating—that would force the new government’s hand, setting the stage for the policy-driven turbulence of the second half.

1.2. Second Half 2025: New Leadership, Market Overheating, and Heightened Regulation

The inauguration of the new government marked the beginning of a new phase for the market. Initially, the administration moved to cool speculative activity by strengthening loan regulations. This led to a paradox of slowing transaction volume while prices continued their upward climb—a phenomenon caused by tighter credit pricing out smaller, leveraged buyers, while cash-rich investors and those pursuing high-value assets in prime locations remained active, driving up the average price index.

The government’s subsequent announcement of major supply-side policies also failed to temper buyer enthusiasm. Instead, strong buyer sentiment persisted, fueling a “pre-emptive rally” as market participants rushed to purchase properties in anticipation of future price gains and tighter restrictions. This activity reached its zenith just before the government’s comprehensive “10.15 Measures” were announced in October. The key themes of this period were the policy direction of the New Government, which reacted to clear signs of Market Overheating with a Strengthening of Regulations, including the designation of new Regulated Areas; despite this, major Supply announcements failed to cool a market caught in a Pre-emptive Rally. The forceful regulatory response in late 2025 established the primary tensions that will shape the core challenges of 2026.

2. Key Market Drivers for 2026

The Korean real estate market in 2026 will be shaped by the interplay of three primary forces: deliberate government policy aimed at market control, the fundamental dynamics of supply and demand, and the overarching financial environment, particularly interest rates. This section will dissect each of these critical drivers.

2.1. The Regulatory Landscape: Expansion and Market Control

The government’s policy stance for 2026 is set to be a direct continuation and expansion of the measures introduced in late 2025. Guided by a strategy of regulatory expansion to rein in an overheated market, the administration will maintain its tight control over real estate activity. The regulatory tightening from H2 2025, including stringent loan restrictions and the designation of specific regulated areas, will form the bedrock of policy in the coming year.

Anticipated Regulatory Focus in 2026

- Loan Regulation: Continued strengthening of lending criteria, primarily through lower Loan-to-Value (LTV) limits and stricter Debt Service Ratio (DSR) calculations, to manage household debt and constrain purchasing power.

- Designated Regulated Areas: The strategic use and potential expansion of zones with stricter transaction, loan, and tax requirements to target and cool specific geographic hotspots.

This firm regulatory posture is the most significant variable for the 2026 market, creating a powerful headwind that will influence both supply-side decisions and buyer demand.

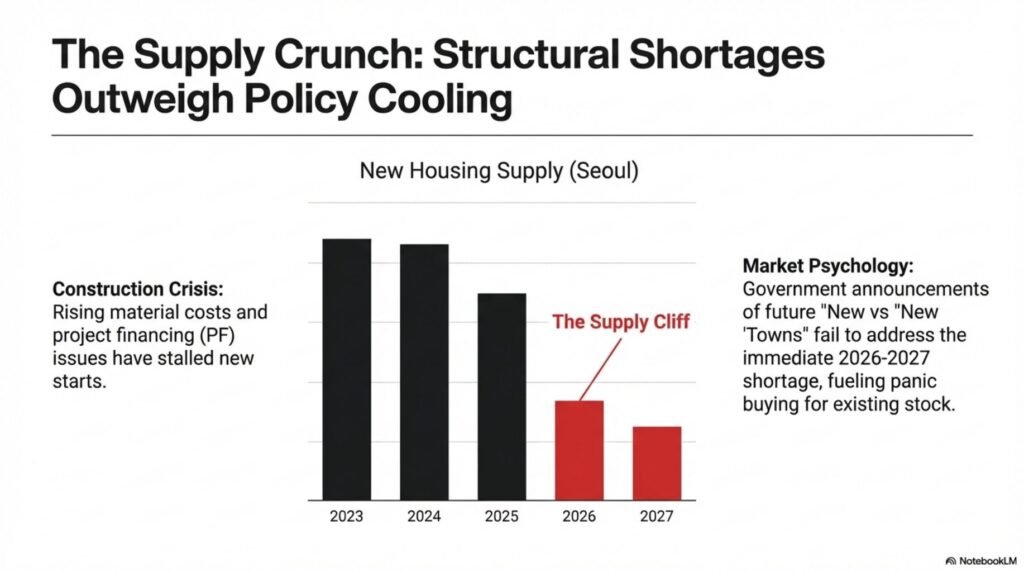

2.2. Supply and Demand: A Structural Realignment

The fundamental supply and demand dynamics in 2026 are projected to undergo a significant reorganization. This shift will be driven by the tension between the government’s long-term supply initiatives announced in 2025 and the persistent, though now constrained, buyer demand. The market is moving away from broad-based growth toward a more segmented and nuanced environment.

The interaction between supply and demand can be best understood by observing trends across key market segments:

- Sales Market Trends: As the primary indicator of homeowner and investor sentiment, the sales market will directly reflect the impact of regulatory and financial pressures on buyer behavior.

- Pre-sale/New Construction Market: This segment serves as a crucial forward-looking indicator of future housing inventory and developer confidence in the face of ongoing regulatory oversight.

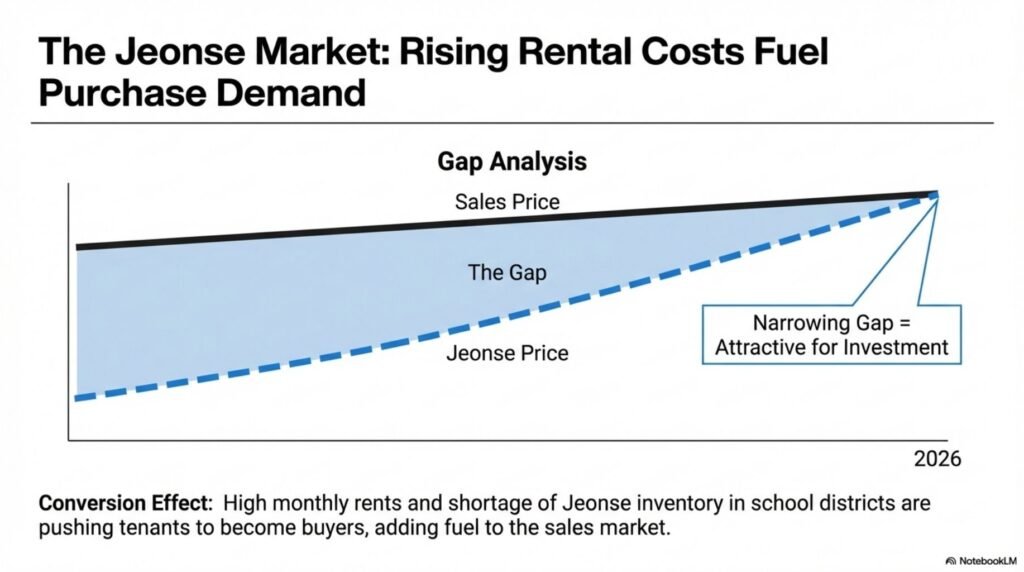

- Rental (Jeonse/Wolse) Market: Instability or rising costs in the Jeonse market can force tenants to consider purchasing, adding a layer of non-discretionary demand to the sales market even in the face of tightening credit conditions.

While these supply and demand fundamentals define the market’s structure, the cost and availability of capital act as the ultimate throttle on activity, making the financial environment the decisive variable for 2026.

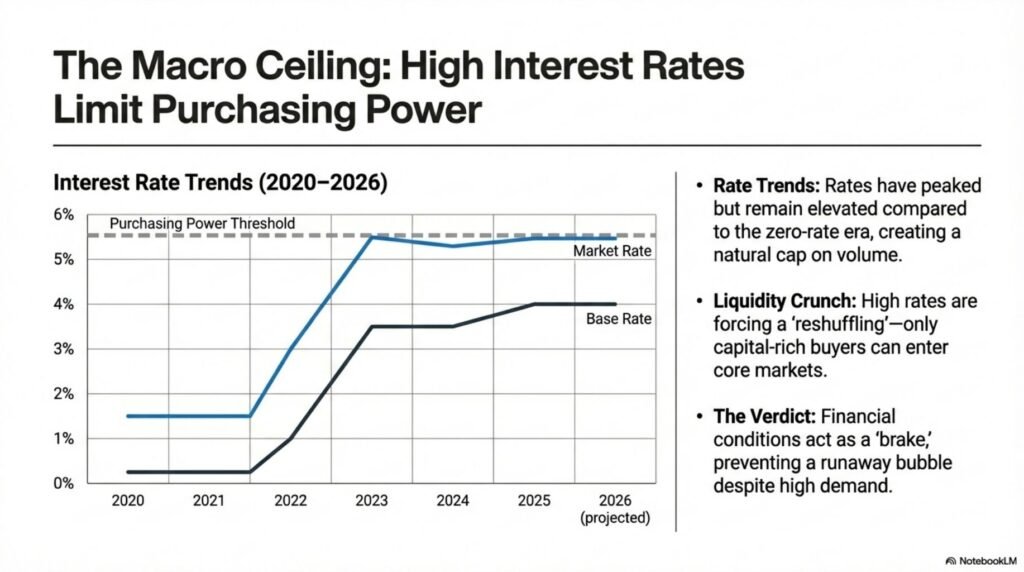

2.3. The Financial Environment: Interest Rates and Credit Conditions

The financial environment, particularly the direction of interest rates and credit availability, will be a critical determinant of market performance in 2026. The strengthened loan regulations from 2025 will continue to directly impact buyer affordability and are set to keep transaction volumes below their recent peaks.

Furthermore, interest rate policy will serve as a primary macroeconomic tool for the government to manage both inflation and market heat. Any adjustments to the benchmark rate will have an immediate effect on borrowing costs for potential homebuyers, acting as a powerful lever to either stimulate or cool activity. A tightening financial environment, coupled with direct regulatory controls on lending, creates a formidable barrier for many prospective buyers. In summary, the combination of a strict policy framework, shifting market fundamentals, and tightening credit conditions points toward a complex and highly segmented market landscape for 2026.

3. Conclusion and Strategic Outlook for 2026

The 2026 Korean real estate market is poised at a critical juncture. It will be defined by the new government’s firm regulatory resolve clashing with the persistent, albeit reorganized, demand that fueled the 2025 rally. The era of unchecked price growth is over, giving way to a period of stabilization where government intervention is the dominant market force. For investors and market participants, success will depend on navigating this new reality with strategic foresight.

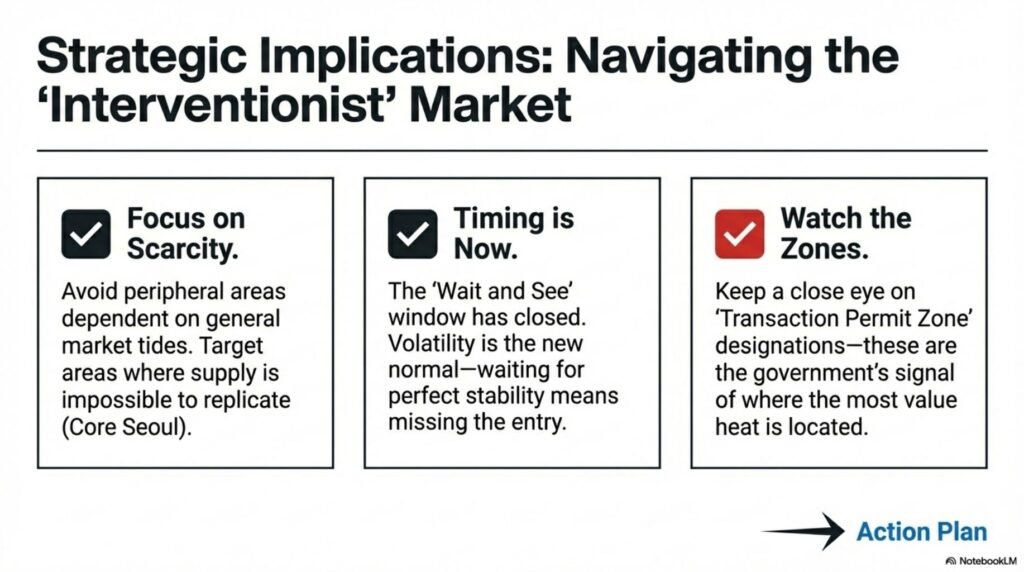

Three primary strategic takeaways emerge from this analysis:

- Regulatory Vigilance is Paramount Government policy will be the single most important driver of market behavior in 2026. Success will require anticipating policy shifts—not just reacting to them—by closely monitoring announcements on lending standards and the designation of regulated zones, as these will directly dictate market access and asset performance.

- Demand Reorganization Creates Niche Opportunities While overall market momentum will cool, the “reorganization of demand” signals a significant shift in capital flows. This will create niche opportunities for astute investors, particularly in non-regulated zones or in property types less sensitive to DSR-based lending caps that remain attractive to cash-rich buyers. A broad-market approach is no longer viable.

- From Price Rally to Market Stabilization The “pre-emptive rally” that characterized H2 2025 is unsustainable against strong regulatory headwinds and tightening financial conditions. The forecast for 2026 is a transition toward price stabilization, with a high probability of correction in previously overheated segments as the full weight of government measures takes effect.

Navigating the complexities of the 2026 market will demand agile, data-driven strategies that are highly attuned to the evolving policy environment.