Introduction: Navigating a Landscape of Structural Change

The global landscape is undergoing a period of profound structural change, moving decisively away from the geopolitical and economic norms that defined the post-Cold War era. Established patterns of international cooperation, trade, and financial stability are being challenged by a confluence of political, military, and technological forces. To navigate this new environment, strategic planning and risk management must be informed by a clear-eyed view of the forces shaping our future. This analysis synthesizes proprietary research from the Hyundai Economic Research Institute to deliver a definitive view of the seven critical global trends projected for 2026.

The following seven trends will be examined in detail:

- The Ascendancy of Populism

- The Normalization of Global Conflict

- The Shifting Formula of Global Economic Growth

- Heightened Systemic Risk in Capital Markets

- The Squeeze on Global Middle-Class Consumption

- The AI Dichotomy: Transformative Engine or Speculative Bubble?

- The Maturation of the Digital Asset Market

The analysis begins with the primary political trend that is reshaping governance, international relations, and the global economic order.

——————————————————————————–

1. The Ascendancy of Populism

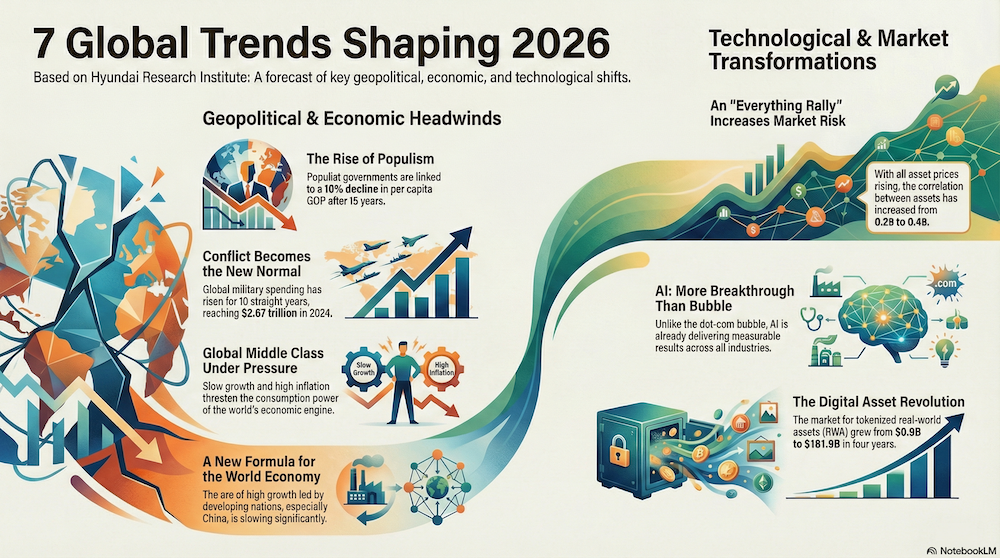

Understanding the global rise of populism has become a strategic necessity. This political phenomenon not only reshapes domestic policy and undermines economic stability but also intensifies geopolitical friction and global uncertainty. Its proliferation demands a recalibration of strategic assumptions about political risk and international cooperation.

Defining the Trend

Populism is a political approach that promotes policies representing a specific segment of the population, often at the expense of broader economic stability and international harmony. Research indicates that its consequences are tangible and negative. An analysis by Manuel Funke et al. (2024) found that after 15 years of populist rule, a nation’s per capita GDP is typically 10% lower than it would have been on a normal growth trajectory.

Analysis of Drivers and Manifestations

The surge in support for right-wing populist parties, as evidenced by gains in Italy, the UK, and France, is not merely a political realignment but a leading indicator of democratic erosion.

Support for European Right-Wing Populist Parties (2016 vs. 2025)

| Party | 2016 Support | 2025 Support |

| Forza Italia | 30% | 51% |

| Reform UK | 26% | 37% |

| National Rally | 23% | 35% |

| PiS | 42% | 30% |

| AfD | 13% | 21% |

This political shift directly correlates with a global decline in freedom and a polarization of governance systems.

- Decline in Freedom (2015 vs. 2025): Based on the World Freedom Index, the number of ‘Free’ and ‘Partly Free’ countries each decreased by 5, while the number of ‘Not Free’ countries increased by 8.

- Polarization of Governance (2015 vs. 2024): According to the Democracy Index, the political landscape is polarizing. While the number of ‘Authoritarian’ regimes increased by 6, the number of ‘Full democracies’ also rose by 5. This growth came at the expense of ‘Flawed democracies,’ which saw their ranks shrink by 14, suggesting nations are moving toward the political extremes rather than a moderate center.

- Shifts in Key Nations: The United States has been reclassified from a “full democracy” to a “flawed democracy” since 2015, while Ukraine has shifted from a “flawed democracy” to a “hybrid regime.”

Implications for Global Stability

This political transformation is directly correlated with rising economic and geopolitical uncertainty. The Global Economic Policy Uncertainty Index reached 342.8 in October 2025, and the Trade Policy Uncertainty Index hit an exceptional 389.4 in November 2025—far exceeding their respective 2010 averages of 197.4 and 94.2. Similarly, the Geopolitical Risk Index stood at 99.9 in November 2025, remaining elevated above the pre-Russo-Ukrainian war average of 92.8 and reflecting a highly unstable global environment.

Strategic Imperative

The ascendancy of populist governments poses a significant latent threat to the global economy, geopolitical stability, and the integrity of supply chains. It is imperative for organizations and governments to develop both pre-emptive and responsive measures to identify and minimize these emerging risks.

This trend of rising political friction directly contributes to the broader normalization of military and trade conflicts across the globe.

——————————————————————————–

2. The Normalization of Global Conflict

The foundational premise of a peace-oriented international order is being replaced by a new reality. Military conflicts and entrenched trade disputes are no longer exceptional events but are becoming structural, everyday features of the global system. This requires a strategic shift away from conflict prevention and toward a model of continuous, multi-layered risk management.

Analysis of Military and Trade Tensions

- Escalating Military Engagement: The complexity and scope of military conflicts are expanding. In 2024, a total of 17 countries experienced over 1,000 deaths from internal conflicts, the highest number recorded since 1999. Over the last five years, 98 nations have been involved in conflicts, marking a 66% increase from 2008.

- Surging Defense Expenditures: Heightened threat perceptions are driving a rapid and sustained increase in global military spending. Global military expenditure reached $2.6765 trillion in 2024, marking the tenth consecutive year of growth.

- Entrenched Protectionism: The structural accumulation of trade restrictions has become a defining feature of the global economy. As of 2025, the cumulative value of trade affected by active import regulations is $4.693 trillion, a figure that now covers 19.7% of total global imports.

- Structural Disputes in Global Trade: Tensions within the World Trade Organization (WTO) are intensifying, signaling a breakdown in multilateral cooperation. The annual average of trade concerns raised between 2020 and 2025 was 305 cases, an 81% increase from the 2010-2019 average of 169. Critically, approximately two-thirds of these were re-raised issues, indicating a shift from temporary disagreements toward long-term, structural disputes.

Strategic Imperative

This paradigm shift renders traditional conflict-avoidance strategies obsolete. The new strategic imperative is not conflict prevention but the development of institutional resilience to operate within a state of persistent, low-grade military and economic warfare. This reality demands strategies focused on protecting strategic industries, diversifying critical supply chains, and enhancing organizational and national conflict-response capabilities.

The consequences of this geopolitical friction are now causing structural changes in the fundamental mechanics of the global economy.

——————————————————————————–

3. The Shifting Formula of Global Economic Growth

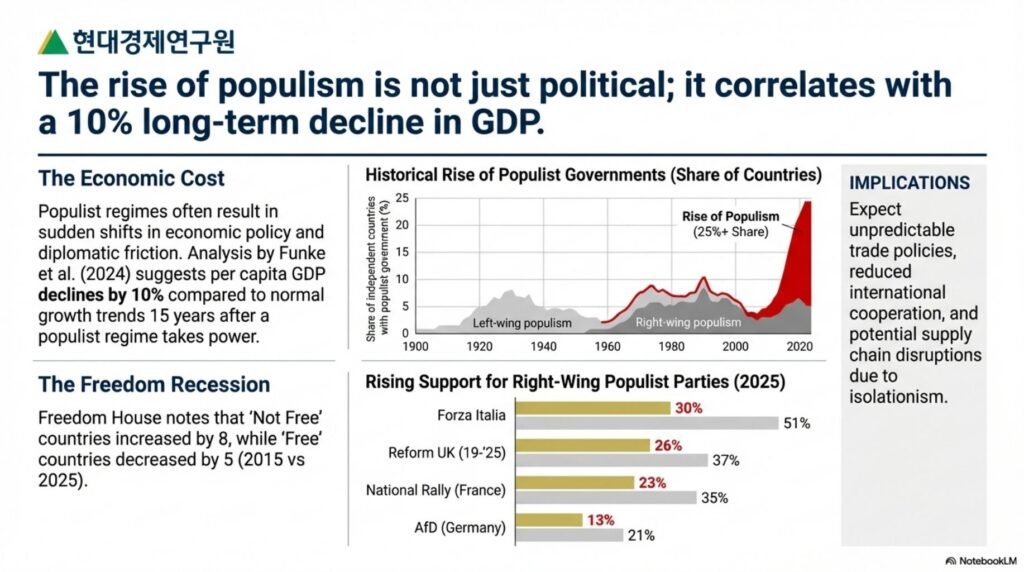

The long-standing economic model that powered global expansion for decades—driven by the high growth of developing nations—is entering a phase of structural transition. The pronounced slowdown of key emerging economies, particularly China, is fundamentally altering global capital and trade flows, rewriting the formula for international economic growth.

Analysis of the Growth Engine Slowdown

The growth momentum of developing economies, which averaged an impressive 5.4% from 2000 to 2019, has weakened considerably. Post-pandemic, these economies have stagnated in the low 4% range without a clear path to recovery.

The primary driver of this trend is China’s economic slowdown. As China’s economy constitutes 40.2% of all developing economies, its deceleration has a profound global impact. Projections indicate that China’s growth rate is expected to fall below the developing country average after 2028, signaling a definitive end to its role as the world’s primary growth engine.

Consequences for Global Capital and Trade

- Shifting Investment Flows: The attractiveness of developing nations for Foreign Direct Investment (FDI) is waning. This is most evident in China, where FDI decreased from a peak of $0.19 trillion in 2022 to $0.12 trillion in 2024. In contrast, capital is increasingly flowing toward developed nations, whose share of global FDI has risen to 42.5%, led by the United States.

- Rebalancing Trade Dynamics: The global trade environment has become less favorable for developing countries. Their collective export growth rate (2.0% as of October 2025) has fallen behind that of developed nations (2.6%). This trend reversal is driven by strategic supply chain reorganizations, reshoring initiatives in advanced economies, and entrenched protectionism.

Strategic Imperative

The established formula for global economic growth is changing. Recognizing this structural shift is the first critical step for strategic adaptation. The imperative is to reinforce proactive investment strategies focused on the key industries and geographic regions poised to benefit from this new economic landscape.

These macroeconomic shifts are occurring alongside the emergence of specific and heightened risks within the world’s financial markets.

——————————————————————————–

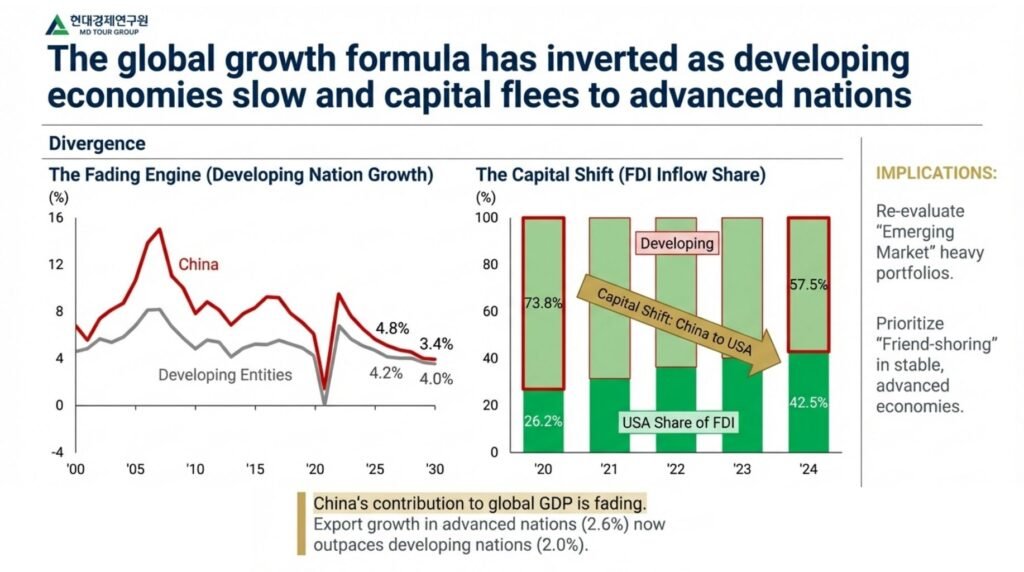

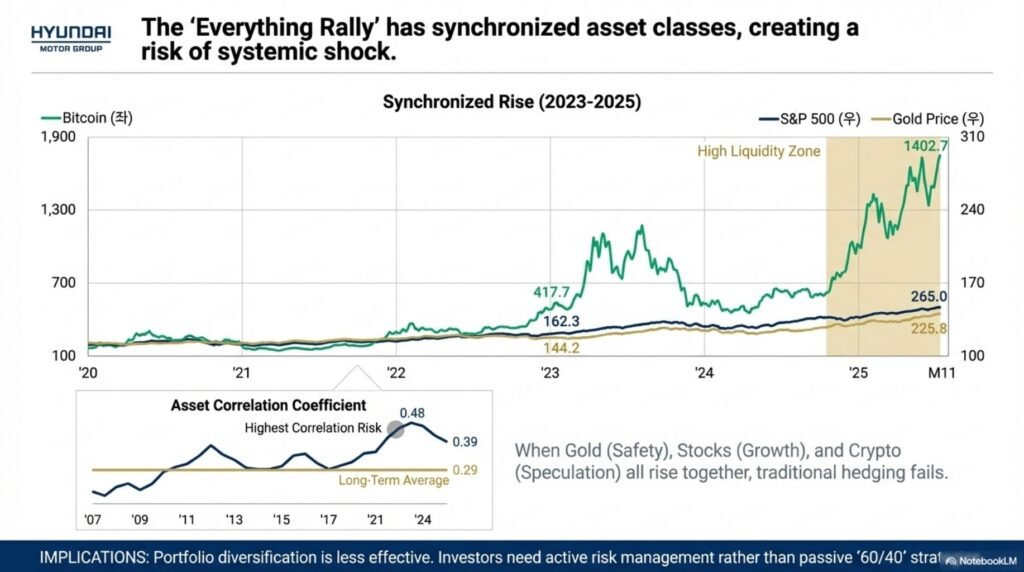

4. Heightened Systemic Risk in Capital Markets

A dangerous phenomenon known as the “Everything Rally”—the simultaneous rise of nearly all asset classes—is increasing risk synchronization across capital markets. Its persistence is weakening the market’s natural resilience and raising the probability that a relatively minor shock could trigger a systemic, market-driven crisis with severe consequences for the real-world economy.

Drivers of the “Everything Rally”

The primary drivers of this trend are expanding global liquidity and a cycle of central bank rate cuts. The M2 money supply of the G4 nations (United States, European Union, China, and Japan) expanded to $96.1 trillion in October 2025. This liquidity injection, combined with strong market expectations of rate cuts in the second half of 2023 followed by actual cuts beginning in 2024, has fueled a sustained and simultaneous rally in both traditional safe-haven assets and risk assets.

Analysis of Weakened Market Resilience

The traditional hedging function of safe assets, such as government bonds and gold, has been compromised. As their prices have risen in tandem with risk assets like stocks and cryptocurrencies, their ability to buffer portfolios during a downturn has diminished.

This increased risk synchronization is quantifiable. The moving correlation coefficient among 11 major global assets, which remained in the low-to-mid 0.2s from 2007 to 2020, has structurally shifted higher into the 0.3 to 0.5 range since 2021. This structural shift in asset correlation invalidates traditional portfolio diversification models. In this environment, assets that were once non-correlated are now likely to decline in unison, meaning systemic risk cannot be effectively hedged, only avoided or absorbed. This elevates the risk that a potential shock, such as the bursting of a perceived AI bubble, could cascade across the entire capital market and inflict substantial damage on the real economy.

Strategic Imperative

Governments must intensify their monitoring of global capital markets and persistently manage emerging systemic risks. For investors, this synchronized and fragile environment necessitates a strategic pivot away from excessive risk-seeking behavior and toward more robust and diversified risk management frameworks.

The risks facing financial markets are compounded by the direct economic pressures affecting the global consumer base.

——————————————————————————–

5. The Squeeze on Global Middle-Class Consumption

The global middle class has long been a primary engine of economic growth and a stabilizing social force. However, a concerning confluence of slow growth, persistent inflation, and higher-for-longer interest rates is exerting significant pressure on middle-class finances. This trend threatens to dampen global consumption, weaken demand, and undermine the foundations of the global economy.

Analysis of Economic Pressures

The global middle class—defined as individuals with a daily income of 11-110—is still projected to grow, increasing from an estimated 4.62 billion people in 2025 to 5.41 billion in 2030. However, this growth engine is facing significant headwinds that will likely temper its economic impact.

- Subdued Economic Growth: World economic growth is forecast to be 3.2% for the 2025-2030 period, a rate that remains below the 2010s average of 3.7%.

- Persistent Inflation: Global consumer price inflation is expected to remain at 3.5% between 2025 and 2030. For most regions outside of emerging Asia, this represents a higher level of sustained price pressure than was experienced in the 2010s.

- Higher-for-Longer Interest Rates: Major central bank rate-cutting cycles are expected to conclude in 2026 at levels significantly higher than their pre-pandemic floors. By the end of 2027, policy rates in the UK, Canada, Australia, and South Korea are projected to be 0.5 to 2.75 percentage points higher than before the pandemic, translating directly into higher borrowing and living costs for middle-class households.

Strategic Imperative

The erosion of middle-class purchasing power is a material threat to global economic stability. A sustained slowdown in this cohort’s consumption will directly translate into reduced demand for consumer exports and a contraction in global services like tourism. Countermeasures across both domestic and export-oriented sectors are no longer optional but essential for mitigating these consequences.

Beyond these broad economic and social trends, specific technological forces like AI and digital assets are simultaneously creating new opportunities and risks.

——————————————————————————–

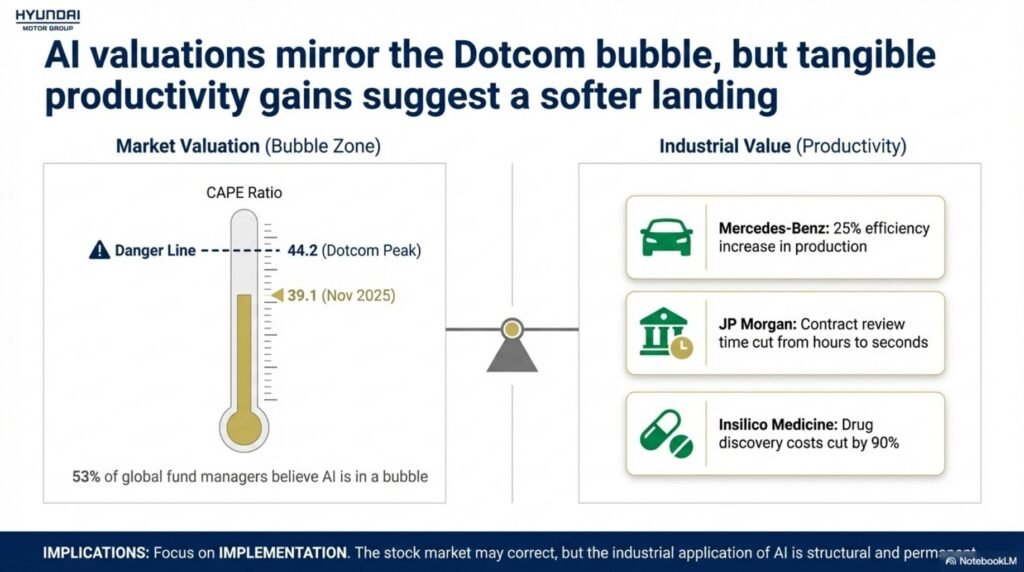

6. The AI Dichotomy: Transformative Engine or Speculative Bubble?

Artificial Intelligence (AI) has rapidly emerged as a core technology for industrial innovation and economic competition. However, its meteoric ascent has created a fierce debate, casting the technology in a dual narrative. This section analyzes the dichotomy surrounding AI: its vast potential as a long-term engine for economic transformation versus the immediate and tangible risk of a speculative bubble.

Evidence of a Potential Bubble

Concerns are mounting that AI company valuations have become excessive and disconnected from their current profitability and technological maturity.

- A November Bank of America survey found that 53% of global fund managers believe AI stocks are already in a bubble.

- The Cyclically Adjusted Price-to-Earnings (CAPE) ratio for the U.S. market, a key valuation metric, reached 39.1 in November. This level is rapidly approaching the dot-com bubble’s peak of 44.2, recorded in December 1999.

Argument for Long-Term Transformation

Despite valid concerns about market froth, compelling evidence suggests AI is on a long-term growth trajectory that differentiates it from past technological bubbles. Two factors are key:

- Broad Industrial Application: Unlike the dot-com era, which was largely confined to the IT sector, AI is a general-purpose technology being applied across all industries, including manufacturing, finance, and biotechnology. Its impact is horizontal, not vertical.

- Measurable Performance: AI is already delivering tangible, measurable results in critical business functions such as production optimization, R&D acceleration, and marketing effectiveness. This demonstrates a real-world utility that extends far beyond pure speculation.

Strategic Imperative

While short-term market corrections are possible, the long-term potential for an AI-driven industrial revolution is significant and should not be underestimated. This reality makes it imperative for nations to accelerate investment in data and AI infrastructure. Furthermore, governments and organizations must proactively realign labor forces and regulatory systems to prepare for the profound structural changes that AI will bring.

While AI reshapes the world of software and data, a parallel transformation is occurring in the market for blockchain-based digital assets.

——————————————————————————–

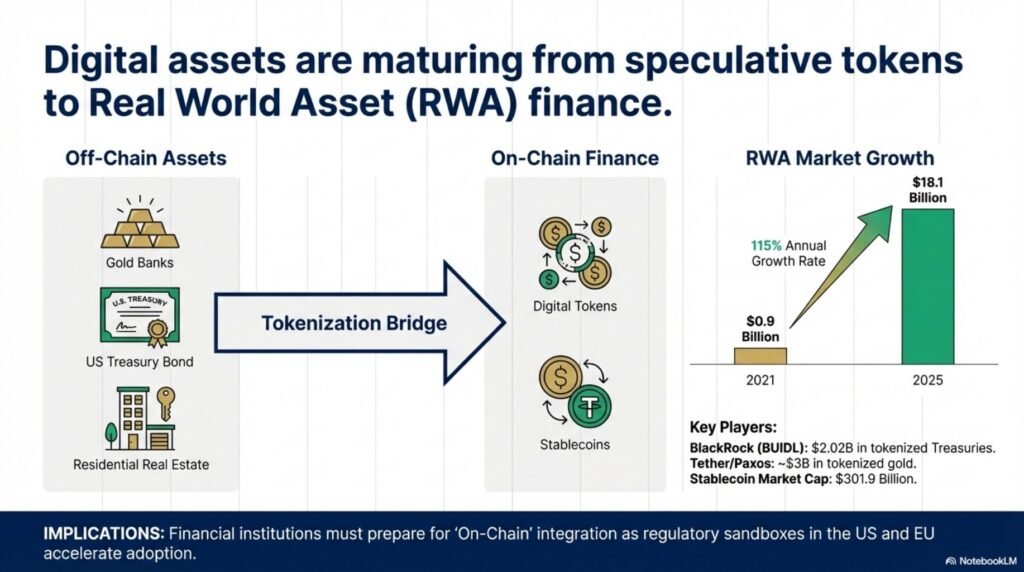

7. The Maturation of the Digital Asset Market

The digital asset market is undergoing a structural transformation, evolving from its origins as a speculative arena dominated by unbacked cryptocurrencies toward a more mature and integrated component of the global financial system. Its future will be built on two pillars: the tokenization of real-world and financial assets (RWA) and the institutional-grade infrastructure provided by stablecoins.

Analysis of Market Evolution

The definition of digital assets has expanded, with institutions like the IMF and BIS now recognizing a broad ecosystem that includes not just cryptocurrencies but also stablecoins, tokenized securities, and RWA tokens.

- The Rise of RWA Tokenization: The tokenization of real-world assets—such as bonds, stocks, real estate, and art—on blockchain platforms represents the next major growth opportunity in finance. The market’s growth has been explosive, expanding from just 0.9 billion** in December 2021 to **18.19 billion by December 7, 2025. This represents an average annual growth rate of approximately 115%.

- The Role of Stablecoins: Stablecoins are poised to become the critical payment and liquidity infrastructure connecting traditional (off-chain) and decentralized (on-chain) finance. They function as the primary on-ramp and off-ramp for capital, allowing institutional funds to move from traditional fiat currency into the tokenized asset ecosystem with minimal friction and volatility, a precondition for large-scale market growth.

- Institutionalization and Regulation: The market is rapidly institutionalizing as key financial hubs like the United States, the European Union, Hong Kong, and South Korea establish clear regulatory frameworks to govern the issuance and trading of digital assets, moving the sector toward mainstream adoption.

Strategic Imperative

The digital asset market is developing at a rapid pace. For this reason, governments and corporations must prepare thoroughly for this technological and financial transition. Proactive engagement and public-private collaboration are required to refine regulatory frameworks, explore applications, and secure a competitive position in the evolving global digital economy.

The following conclusion synthesizes these seven distinct trends into a holistic view of the global strategic environment.

——————————————————————————–

Conclusion: Strategic Synthesis for 2026

The seven trends analyzed in this document are not isolated phenomena but deeply interconnected forces that are collectively reshaping the global strategic environment. Their combined impact points toward a future defined by two overarching themes: an era of interconnected volatility and the corresponding imperative of strategic resilience.

- An Era of Interconnected Volatility: The rise of populism fuels geopolitical conflict and trade protectionism. This, in turn, disrupts the established formulas of economic growth and destabilizes supply chains. Heightened market fragility, driven by the “Everything Rally,” makes the global financial system more vulnerable to shocks, whether they originate from geopolitical events or the bursting of a technological bubble in a sector like AI. The result is a highly volatile, unpredictable, and complex global landscape where risk in one domain can rapidly cascade into others.

- The Imperative of Strategic Resilience: In this new environment, success will not be defined by the ability to perfectly predict the future, but by the capacity to build resilience against uncertainty. This requires a fundamental shift in strategic thinking. Key actions include systematically diversifying supply chains to mitigate political risk, managing financial exposure with greater caution in synchronized markets, and making targeted investments in transformative technologies like AI to secure long-term competitiveness. Ultimately, it demands the adaptation of business models and national policies to a world of shifting economic and political allegiances.

Navigating the world of 2026 and beyond will demand constant vigilance, adaptability, and a commitment to proactive strategic planning. The structural changes now underway are profound, and preparing for their consequences is the central challenge for leaders across every sector.