——————————————————————————–

1.0 Introduction: The Modern Investor’s Edge

In today’s complex financial landscape, the strategic use of debt has become one of the most critical, yet widely misunderstood, components of modern wealth creation. For many, a loan is simply a liability—a necessary burden to acquire an asset. For the strategic investor, however, it is a powerful tool for leverage and growth. I am Shaun Goon (숀군), a “Loan Master” (대출 도사). After a 21-year career in the Tier-1 financial sector, which I completed in 2022, I now apply those field-tested strategies as a full-time investor and advisor. Today, we will move beyond the basic view of borrowing and explore a sophisticated framework for turning debt into your most valuable asset.

My approach is built not on abstract theory, but on decades of hands-on experience:

- Professional Background: 21 years of comprehensive experience in lending, including practical application, sales, and loan review within a Tier-1 financial institution.

- Advisory Experience: 8 years as a loan instructor with over 600 successful coaching cases and a study group of over 900 members.

- Investment Praxis: Active full-time investor since 2017, transitioning from residential to income-producing properties.

This presentation will equip you with a core philosophy and a tactical playbook to architect your finances for long-term, resilient growth.

2.0 The Core Philosophy: Transforming Loans from a Liability to an Asset

Before we delve into specific tactics, we must first adopt the correct mindset. The strategic use of debt is not about finding loopholes; it is a foundational philosophy that re-frames the entire purpose of borrowing. This perspective is what separates amateur investors from professional wealth builders, turning loans from financial burdens into powerful investment tools.

This philosophy rests on three fundamental principles:

- The Double-Edged Sword: In a capitalist system, a loan is a “double-edged sword.” When understood and managed with expertise, it is the single best tool for amplifying your investment power. When misunderstood or mismanaged, it becomes the worst kind of financial shackle, limiting your options and exposing you to unnecessary risk.

- Interest as the Cost of Opportunity: We must reframe our view of interest. It is not merely an expense; rather, “interest is the cost for opportunity.” You are strategically paying for the ability to acquire assets and access growth potential that would otherwise be out of reach.

- Risk Management, Not Avoidance: The most crucial shift in thinking is understanding that loan risk is a factor to be managed, not avoided. Attempting to eliminate all risk is a futile exercise that paralyzes growth. For a strategic investor, this is not a suggestion; it is an unconditional command.

The ultimate goal of this philosophy is to create a financial structure robust enough to “endure” market cycles. By building resilience into your debt portfolio, you protect your assets from forced sales during downturns, preserving your capital and positioning you to capitalize on long-term market appreciation. This philosophy provides the ‘why’; now let’s explore the ‘how’.

3.0 The Three Pillars of Strategic Lending

Many investors operate under the dangerous misconception that successful borrowing is simply about securing the largest possible loan amount. This approach is not a strategy; it’s a gamble. True financial architecture moves an investor from reactive borrowing to a proactive, structured approach built on three core pillars. Mastering these areas is the key to unlocking maximum borrowing potential while simultaneously building a resilient financial foundation.

The three pillars of strategic lending are:

- Loan Sequencing (대출 순서): The order in which you acquire different types of debt can dramatically alter your total borrowing capacity.

- Borrower & Ownership Strategy (대출 명의): The legal entity or individual named as the borrower is a strategic choice that impacts risk, liability, and future opportunities.

- Loan Structuring & Terms (대출 구조): The specific terms of a loan—repayment type, term length, and interest rate—are tools to build resilience and optimize cash flow.

We will now examine the first and most frequently overlooked pillar: the critical impact of Loan Sequencing.

4.0 Pillar 1: The Critical Impact of Loan Sequencing

Loan sequencing is one of the most powerful and underutilized levers in personal and business finance. Due to regulations like DSR (Debt Service Ratio), the order in which you take on loans has a direct and often dramatic impact on your total borrowing capacity. Getting the sequence right triples the size of the mortgage you can secure.

Consider the profound financial impact of correct sequencing for an individual with an annual salary of 8,000 units:

| Scenario | Loan Sequence | Total Borrowing Capacity |

| A (Incorrect) | 1. Personal Credit Loan (8,000) <br> 2. Mortgage (16,000) | 24,000 |

| B (Correct) | 1. Mortgage (48,000) | 48,000 (enabling a 3x larger mortgage) |

By simply securing the mortgage before the personal credit loan, the investor doubles their total available capital. This is a strategic decision that costs nothing but yields a massive return.

Key sequencing decisions that investors must strategically plan for include:

- Home Purchase: Always secure the mortgage loan before applying for a personal credit loan.

- Pre-Construction Win: Proactively manage your credit and debt profile before securing the interim payment loan for a newly won property auction or lottery.

- Business Property: Carefully decide whether a working capital loan or a facility loan should be acquired first when purchasing or constructing a commercial property.

- Small Business Loans (소진공): Choosing between a credit-based loan, a guaranteed loan, or a real estate collateral loan from the Small Enterprise and Market Service.

- SME Loans (중진공): Deciding whether to first pursue a direct loan from the Korea SMEs and Startups Agency or a guaranteed loan via the Korea Credit Guarantee Fund (Shinbo) or Korea Technology Finance Corporation (Kibo).

Understanding the correct order of operations is the first step. The next is determining who, or what entity, should be the borrower.

5.0 Pillar 2: Mastering Borrower and Ownership Structures

The choice of borrower—known as “명의”—is not a mere administrative detail. It is a fundamental strategic decision that directly influences liability, asset protection, risk exposure, and future financial flexibility. A sophisticated investor thinks deeply about who or what entity will hold the debt, leveraging different structures to optimize their portfolio.

Advanced ownership and borrower strategies include:

- Joint Ownership: When acquiring property jointly (e.g., individual/individual or individual/corporation), the selection of the primary debtor is a critical decision. This allows for the strategic allocation of debt to the partner with the strongest future borrowing potential, preserving the other’s capacity for subsequent investments.

- Third-Party Collateral: This strategy involves separating the debtor from the asset provider. One party can take on the loan as the official debtor, while a separate third party provides the real estate as collateral, creating a firewall between the debt obligation and asset ownership. This protects the asset provider’s personal DSR from being impacted by the loan, keeping their own credit lines open.

- Business Partnerships: For joint business owners, critical decisions must be made regarding who will be the primary debtor, whether to use joint guarantors, and how the shareholder composition will be structured. This ensures that financing structures align with the business’s growth strategy while protecting the personal assets of the partners.

Once you have determined the sequence and the borrower, the final pillar is to architect the specific terms of the loan itself.

6.0 Pillar 3: Designing a Resilient Loan Structure

Effective loan management goes beyond securing funds; it is an exercise in “loan architecture.” The objective is to design a loan’s terms to align perfectly with your long-term investment goals, market outlook, and personal cash flow, creating a structure that is fundamentally resilient. This means carefully evaluating the trade-offs of every component of the loan agreement.

Key decision points in loan structuring include:

- Loan Type: A general loan and a line of credit (“마이너스통장”) serve different purposes. Critically, a line of credit is treated as fully utilized for DSR calculations, even if the balance is zero, which can severely impact future borrowing capacity.

- Repayment Method: A bullet/lump-sum repayment (“만기일시상환”) maximizes cash flow during the loan term but carries significant refinancing risk. In contrast, amortization (“분할상환”) reduces principal over time but requires higher monthly payments. Failing to plan for this can be catastrophic; many investors have faced ruin when large amortization payments kicked in after an interest-only period, a situation the lecturer calls “death by repayment schedule.”

- Loan Term: Choosing a short loan term based on the optimistic assumption of a quick sale is a common and dangerous mistake. Always ask the critical question: “What if the property doesn’t sell as planned?” Structure the term for resilience, not for a best-case scenario.

- Interest Rate: A variable rate (“변동금리”) may offer a lower initial cost but exposes you to market volatility. A fixed rate (“고정금리”) provides predictability and stability, which can be invaluable in an uncertain interest rate environment.

Remember this critical warning: “A single moment’s judgment can deplete your bank account.” The structure of your loan is not a minor detail; it is the bedrock of your investment’s stability. With these strategic pillars in place, we must now understand the rules that govern them.

7.0 Navigating Key Regulations and Opportunities

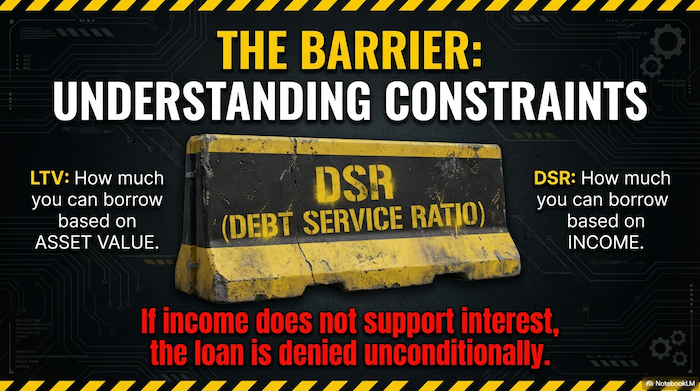

While strategy is paramount, successful execution requires a deep and practical understanding of the current regulatory environment. Financial regulations like DSR and LTV define the boundaries of what is possible. Knowing these rules—and the special programs available—allows an investor to navigate the landscape effectively and legally maximize their opportunities.

Here is a summary of essential regulatory points:

- Business loans are generally exempt from personal DSR and DTI (Debt-to-Income) ratio limits.

- A spouse’s income can be legally combined with the primary applicant’s to increase the household income used for DSR calculations.

- Tier-2 financial institutions (e.g., savings banks) often have a higher DSR ceiling of 50%, compared to the 40% limit at Tier-1 banks.

Investors can also leverage special programs designed for homebuyers:

- First-Time Homebuyer (“생애최초”) Status: This program provides preferential terms for qualified applicants.

- Key Criteria: LTV 60% / DTI 60% in regulated areas, for properties valued under 800 million KRW, with a total household income under 90 million KRW.

- Low-to-Middle Income Actual Demand (“서민 실수요”) Program: Another key program offering enhanced lending terms for qualified households.

- Policy Mortgages: Government-backed programs like “디딤돌” (Didimdol) and “보금자리” (Bogeumjari) operate under their own unique set of rules and should be evaluated separately.

The following table summarizes the LTV/DTI limits for different borrower situations and loan purposes:

| Category | Condition | LTV Limit |

| First-Time Buyer | National (Price/Income Irrelevant) | 70% – 80% |

| Normal Multi-house | 1+ House (non-disposal) | 0% (Ineligible) |

| Non-Regulated | Outside Metropolitan area | 60% – 70% |

8.0 Conclusion: From Theory to Action

We have established that loans are the definitive “double-edged sword” of capitalism—not passive liabilities, but dynamic tools for wealth creation. True financial strength comes not from avoiding debt, but from mastering it. By implementing a strategic framework built on the three pillars—Sequencing, Borrower Strategy, and Structure—you can transform your relationship with debt, amplify your investment capacity, and build a portfolio designed to endure and thrive through any market cycle.

The time has come to move beyond a passive view of finance. I urge you to take these principles and apply them, to actively manage your leverage, and to begin architecting a future of enduring financial success.