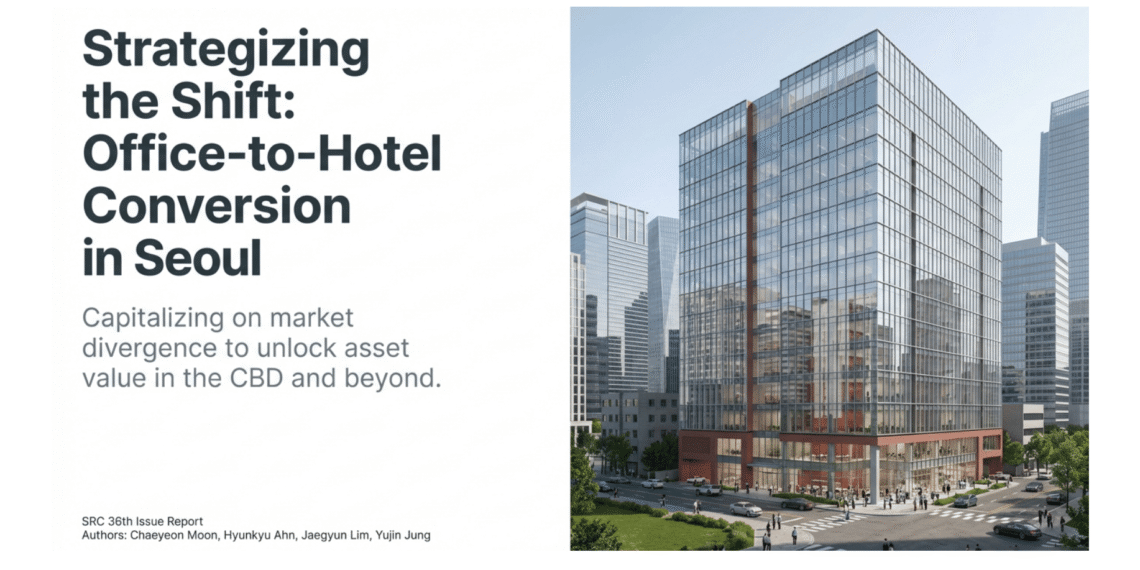

In today’s real estate market, the divergence of two major asset classes—struggling office properties and recovering hospitality—has created a compelling strategic opportunity: the office-to-hotel conversion. This process involves adapting and renovating an office property for use as a hotel, breathing new life into underperforming assets.

This is a growing trend driven by powerful shifts in how we work and travel. As the demand for traditional office space changes and tourism rebounds, converting underused buildings offers a creative solution for investors and cities alike. This article provides a clear, step-by-step guide for anyone new to real estate, explaining why this trend is happening, its benefits and drawbacks, and the key stages involved in bringing such a project to life.

——————————————————————————–

1. The “Why”: Market Forces Driving the Change

The trend of converting offices into hotels isn’t happening in a vacuum. It’s fueled by a powerful combination of a “push” from a struggling office market and a “pull” from a recovering hotel market. Together, these forces create a compelling business case for transformation.

A. The Push: An Oversupply of Office Space

A primary driver for these conversions is the significant oversupply in the office market. As work habits change, many older office buildings are struggling to find tenants, leading to higher vacancy rates.

- In Seoul’s Central Business District (CBD), the office vacancy rate is projected to reach 7.0% by 2025.

- Looking further ahead, the challenge is set to grow. Approximately 750,000 pyeong (nearly 2.5 million square meters / 27 million square feet) of new, Grade-A office space is expected to be supplied in the CBD by 2030.

This flood of new supply will make older, less-equipped buildings—the prime candidates for conversion—even less competitive. This accelerates their obsolescence and makes finding an alternative use, like a hotel, a more urgent and necessary strategy for owners.

B. The Pull: A Resurgence in Tourism and Hotel Demand

On the other side of the equation, the demand for hotel rooms is steadily increasing as global and domestic tourism recovers.

- The number of foreign visitors to Korea is expected to recover to pre-COVID levels in the first half of 2025, reaching approximately 8.82 million people.

- This rising demand is happening at a time when the construction of new hotels has slowed. This gap between high demand and limited new supply creates a perfect market opportunity for conversions to fill.

- As a result, key hotel performance metrics like RevPAR (Revenue Per Available Room) are recovering, signaling a healthy and profitable market for hotel operators.

These parallel trends—too much office space and not enough hotel rooms—make the strategic conversion of an office building a logical and potentially lucrative endeavor.

——————————————————————————–

2. Weighing the Options: The Pros and Cons of Conversion

Like any major real estate project, converting an office to a hotel comes with a unique set of advantages and disadvantages. For an investor, understanding these is the first step in evaluating a potential project.

| Advantages | Disadvantages |

| Reduced Initial Investment Costs | Need for Stable Hotel Operations |

| By reusing an existing structure, investors can often avoid the high costs associated with ground-up construction, making the project more financially accessible. | A hotel’s success depends on expert management, meaning investors must secure a reliable and professional operator to ensure consistent profitability. |

| Shorter Construction Period | Complexity of Changing Use & Permits |

| Renovating an existing building is typically faster than building a new one, allowing the hotel to open and start generating revenue much sooner. | The legal process of changing a building’s designated use and obtaining the necessary permits can be complicated and time-consuming. |

| Flexibility to Respond to Market Changes | Loss of Income During Construction |

| An adaptive reuse project allows investors to pivot their asset’s function to meet current market demand, turning a less profitable office into a high-demand hotel. | Unlike an operational office building, the property generates no rent or revenue during the lengthy renovation, which can significantly impact cash flow. |

After carefully weighing these factors, a developer can decide whether to move forward with the complex but rewarding journey of conversion.

——————————————————————————–

3. The Conversion Journey: A 6-Step Process

An office-to-hotel conversion project follows a structured lifecycle, moving from an initial idea to a fully operational and profitable asset. Each stage requires careful planning and execution.

- Review This initial due diligence phase is critical. It involves a comprehensive analysis of the building’s physical state, its location and market context, and the creation of a detailed financial model to assess project feasibility, costs, and potential returns.

- Acquisition Once the project is deemed viable, this stage involves negotiating and completing the purchase of the office building property.

- Design Architects and interior designers create the new vision for the building, planning everything from the layout of guest rooms and amenities to the mechanical and electrical systems required for hotel operations.

- Construction This is the physical transformation phase, where the old office interiors are stripped out and the new hotel is built according to the design plans, requiring careful project management to stay on time and budget.

- Operation Once the hotel opens, the focus shifts to professional day-to-day management. This includes everything from marketing and guest services to property maintenance, all aimed at maximizing occupancy and revenue to ensure a return on investment.

- Disposition This is the final stage in the investment cycle. After the asset has been stabilized and is operating successfully, the owner may choose to sell the now valuable hotel to another investor to realize their profits.

——————————————————————————–

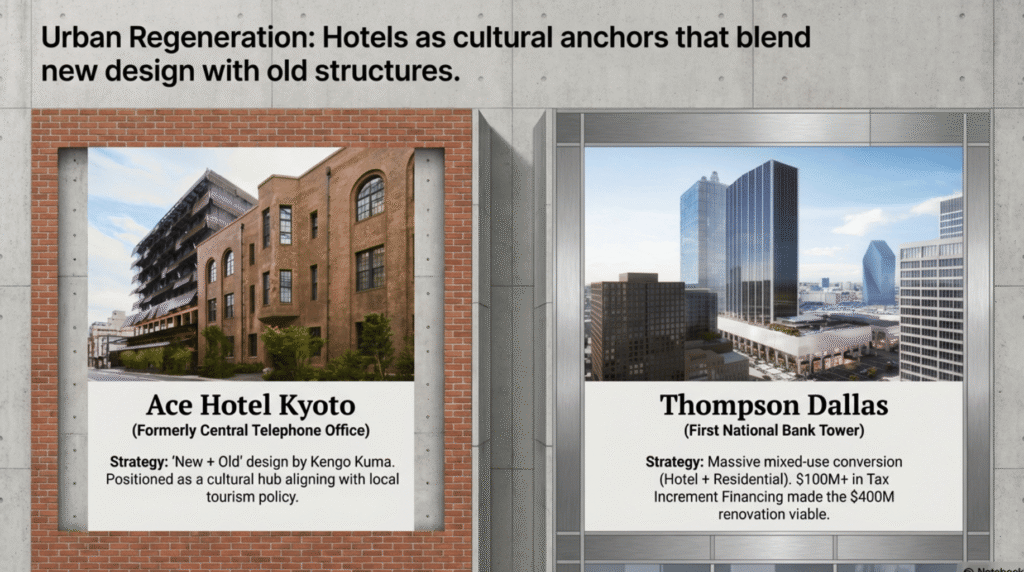

4. From Blueprint to Reality: A Look at Real-World Examples

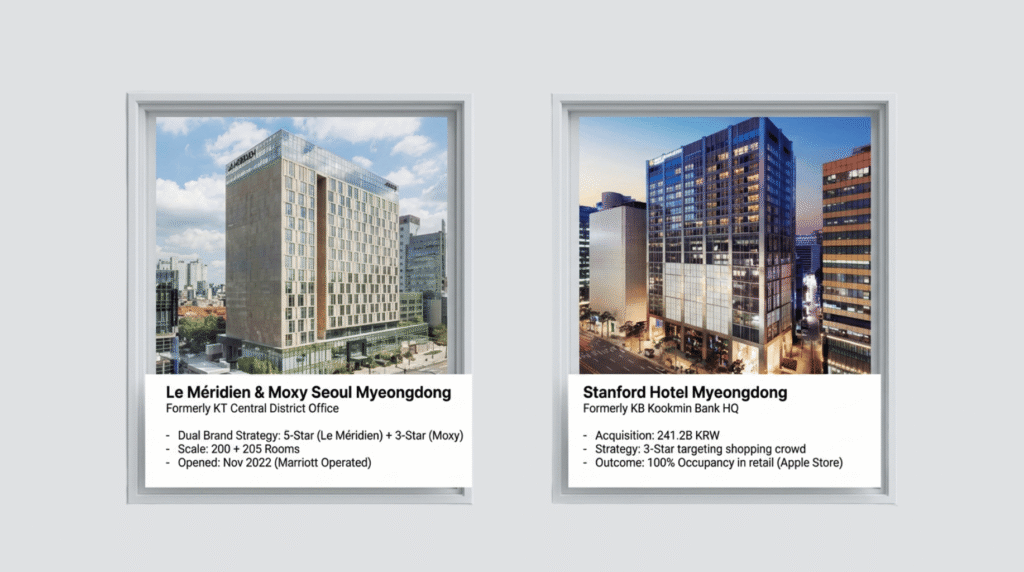

Seeing how these projects unfold in the real world helps illustrate their potential. Here are two examples of successful office-to-hotel conversions from Korea and the United States.

Case Study 1: Stanford Hotel Myeongdong (Seoul, Korea)

- Formerly: KB Kookmin Bank Myeongdong Building

- Key Insight:

- This former bank office building in a prime Seoul location was successfully converted in 2022.

- It is now a 243-room, 3-star hotel catering to tourists and business travelers.

- The project involved converting the building’s upper levels, specifically floors 9 through 19, into guest rooms, completely transforming the building’s purpose and value.

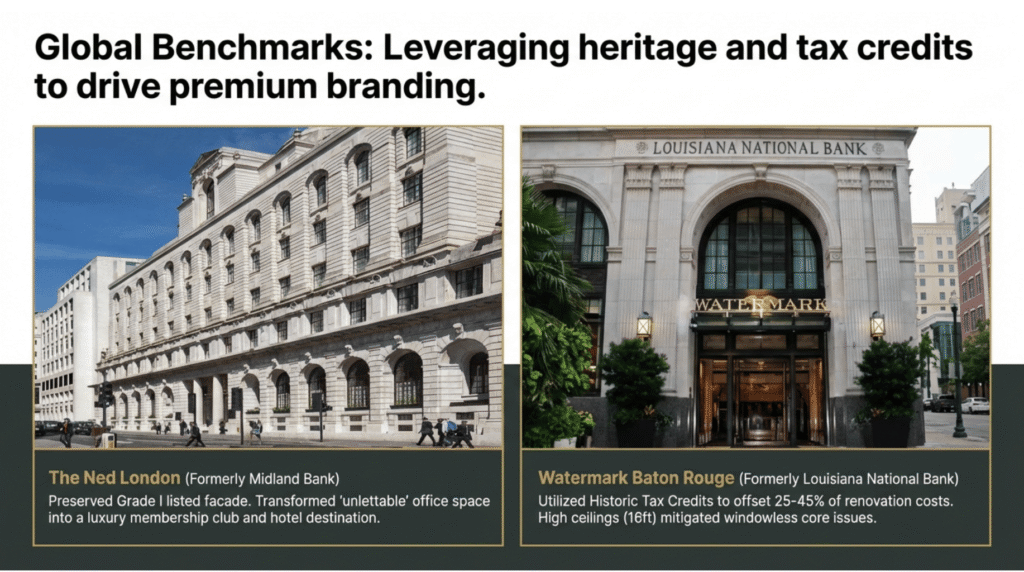

Case Study 2: WATERMARK Baton Rouge (Louisiana, USA)

- Formerly: Louisiana National Bank

- Key Insight:

- This conversion was driven by the functional obsolescence of older office stock from the 1980s and 90s, creating an opportunity to repurpose vacant space.

- The historic bank building was transformed into a 144-room, 4-star luxury hotel, part of the Autograph Collection.

- The project leveraged financial incentives like historic tax credits, which can significantly improve the financial viability of converting heritage buildings.

These cases show that with the right vision and location, an underperforming office can be reborn as a thriving hotel.

——————————————————————————–

5. A Key Hurdle: Navigating Permits and Building Requirements

One of the most significant challenges in any conversion project is navigating the complex web of permits and building codes. Hotels are subject to much stricter regulations than offices to ensure guest safety and comfort. These regulatory hurdles are key risk factors that can directly impact the “Shorter Construction Period” advantage and add to the project’s complexity and cost.

Here are a few key areas where requirements differ:

| Facility Requirement | Office Standard | Hotel Standard (Stricter) |

| Parking | 1 car per 150m² | 0.5 to 1 space per guest room (approx. 1 car per 200m²) |

| Stair Lobby Width | Minimum 1.2m | Minimum 1.5m recommended |

| Soundproofing | No specific standard | Walls between rooms must meet a 45db or higher rating |

Successfully managing these technical and legal requirements is crucial for keeping a conversion project on schedule and within budget.

——————————————————————————–

6. The Future of Urban Renewal

For the savvy investor, office-to-hotel conversion is not merely an act of renovation, but a calculated strategy to capitalize on market shifts. Success hinges on rigorous due diligence, navigating regulatory complexities, and ultimately, a clear vision for transforming an obsolete asset into a valuable, revenue-generating destination. As urban landscapes evolve, those who can master this complex process will lead the way in shaping the future of real estate.

1.0 Financial and Operational Framework

A successful conversion strategy is built upon a foundation of sound financial analysis and a clear operational plan. The viability of this investment is supported by superior return metrics, a navigable regulatory pathway, and the availability of government support mechanisms designed to foster growth in the tourism sector.

1.1 Enhancing Profitability: A Quantitative Assessment

The financial case for conversion is clear, offering a significant uplift in yield compared to retaining an asset as a standard office property. Analysis shows a significant yield uplift, with target hotel assets achieving an average Cap Rate of 5.4% compared to 4.5% for office assets.

This enhanced profitability is also driven by a more dynamic lease structure. Unlike the fixed, long-term Direct Lease model common in office buildings, hotels operate on a Master Lease / Hotel Management Agreement (HMA) model. This structure allows the property owner to participate directly in the operational performance, capturing upside from strong revenue growth. However, it also exposes them to downside risk, necessitating the selection of a best-in-class operator.

1.2 Navigating the Regulatory Landscape

The critical path for any conversion project involves securing a use-change permit to reclassify the property from office to lodging. This process requires expert planning and execution, as hotels are subject to more stringent building and safety codes. Key areas of focus include:

• Parking Standards

• Ceiling Height and Stairwell Width

• Fire Safety and Egress

• Ventilation and Sanitary Facilities

Proactive management of these regulatory requirements is essential to ensure a smooth and timely project delivery.

1.3 Leveraging Government Support Mechanisms

The South Korean government actively encourages investment in the hospitality sector through the “Tourism Promotion Development Fund.” This program provides attractive financing options for the construction, renovation, and operation of tourism facilities. This government support mechanism effectively de-risks the capital stack by providing favorable, long-term financing that reduces reliance on conventional, higher-cost development loans and improves the project’s overall yield-on-cost.

| Fund Use | Maximum Loan Amount | Loan Term |

|---|---|---|

| Construction | KRW 15 billion | 13 Years (incl. 5-year grace period) |

| Renovation | KRW 8 billion | 8 Years (incl. 3-year grace period) |

| Operations | Up to 50% of annual operating costs | 5 Years (incl. 2-year grace period) |

When managed with expertise, this combination of superior financial metrics, a defined regulatory process, and available government incentives creates a clear and compelling pathway to profitability.

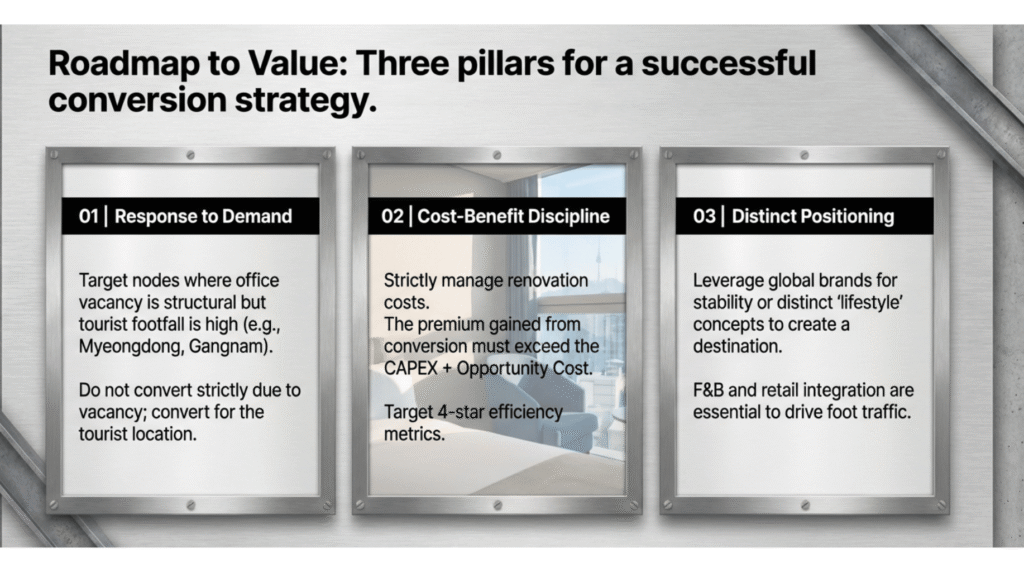

2.0 The Investment Thesis and Strategic Recommendations

The preceding analysis presents a clear and powerful conclusion: the convergence of structural oversupply in the Seoul office market and resurgent, supply-constrained demand in the hospitality sector has created a compelling and time-sensitive investment opportunity. By strategically acquiring and converting underutilized office assets into modern hotels, investors are positioned to capitalize on these powerful market tailwinds. To maximize returns, we propose a disciplined approach guided by the following recommendations.

2.1 Recommendation 1: Prioritize Strategic Asset Selection

Investment must target the acquisition of office assets prime for conversion into 3- to 5-star hotels. This segment is best positioned to capture the broadest and most profitable portion of tourist demand. Asset selection must be rigorous, prioritizing prime locations with strong underlying fundamentals and a physical footprint conducive to an efficient hotel layout.

2.2 Recommendation 2: Maximize Value through Brand and Amenities

Securing a global hotel brand is non-negotiable. It mitigates lease-up risk, provides access to a global distribution system (GDS), and ensures operational excellence, thereby stabilizing cash flow and enhancing the asset’s terminal value upon exit. Furthermore, the redevelopment plan must align with modern traveler expectations by incorporating high-demand amenities such as quality food and beverage outlets, comprehensive fitness centers, and other wellness facilities that are proven to drive higher revenue.

7. Conclusive Statement: A Compelling Case for Superior Returns

This proposal outlines a clear and executable strategy to generate superior returns in the current Seoul real estate market. The strategy directly exploits a clear market dislocation, converting distressed assets in a declining sector into premium assets in a growth market. By acquiring underutilized office assets and executing a strategic conversion into well-positioned, branded hotels, investors can capitalize on definitive market trends to generate superior, risk-adjusted returns and long-term capital appreciation.