1.0 Project Overview: A New Paradigm in Urban Redevelopment

The Urban Public Housing Complex Project is a direct government response to the quantifiable failures of private-sector urban redevelopment in Korea, which has been hamstrung by a 13-year average project timeline. This public-led initiative is engineered to break this gridlock by streamlining development, representing a potential arbitrage opportunity for investors capable of navigating its unique regulatory framework and a significant new asset class focused on accelerating urban housing supply.

Defined under Korea’s Public Housing Special Act, the project empowers public entities like the Korea Land and Housing Corporation (LH) and Seoul Housing and Communities Corporation (SH) to lead high-density redevelopment in underutilized and deteriorated urban areas. Its core objective is to rapidly supply quality housing by exercising eminent domain while revitalizing core urban functions.

The project targets three distinct asset profiles, each with specific criteria and development incentives:

| Project Type | Target Area Characteristics | Key Development Incentives |

| Residential/Commercial High-Density Zone (Station Area) | Located within a 350-meter radius of a railway station platform. Over 50% of buildings are more than 20 years old. | Creates high-density, mixed-use complexes with residential, commercial, and business functions. Allows zoning upgrades to semi-residential or commercial. |

| Residential/Industrial Fusion Zone (Semi-Industrial Area) | Targets aging semi-industrial areas where industrial and residential uses are mixed. Over 50% of buildings are more than 20 years old. | Fuses next-generation industrial facilities with modern residential spaces to support advanced industries while improving the living environment. |

| Housing Supply Activation Zone (Low-Rise Residential Area) | Focuses on low-rise residential areas with poor infrastructure, requiring over 50% building age and meeting at least one deterioration condition (e.g., undersized lots >30%, housing density >60 units/ha, poor road access <30%). | Comprehensively redevelops aging low-rise neighborhoods to create a superior living environment and significantly increase housing stock. |

For a candidate site to advance to official district designation, two critical resident agreement thresholds must be met: a consent rate of at least two-thirds (67%) of property owners and the consent of owners representing at least one-half (50%) of the total land area. This public-led model offers distinct strategic advantages over traditional development approaches by centralizing and accelerating these initial stages.

2.0 The Investment Thesis: Speed, Scale, and Incentives

The investment appeal of the Urban Public Housing Complex Project is rooted in a powerful combination of accelerated project timelines, enhanced development potential through aggressive densification, and a suite of significant regulatory concessions. This section deconstructs these core value propositions, which are further amplified by the government’s “Season 2” initiative designed to overcome initial project headwinds and boost feasibility.

Core Strategic Advantages

- Accelerated Timelines: The public-led model bypasses the need to form a resident union—a notoriously protracted stage in private redevelopment. By mandating integrated reviews for urban planning, architecture, and environmental assessments, the government aims to shorten the development cycle from an average of over 13 years to a target of 4-5 years from district designation to the start of sales.

- High-Density Development: The project provides powerful incentives to maximize housing supply. These include increasing the Floor Area Ratio (용적률) by up to 140% of the legal maximum for the designated zone and upgrading the zoning classification (용도지역) itself. The Jeungsan 4 project, which is transforming a low-rise residential area into a 3,500-unit complex, serves as a prime example of this densification potential.

- Regulatory Relief: A crucial financial benefit is the project’s exemption from the ‘Reconstruction Excess Profit Restitution’ system. This removes a significant tax burden that frequently diminishes the net financial returns for owners in private reconstruction projects, enhancing the project’s appeal to landowners.

- Public-Sector Backing: Project execution by public entities like LH and SH provides a high degree of stability and administrative support. This backing enhances financing capabilities through the public corporation’s creditworthiness and streamlines the complex approvals process, de-risking the project from common financial or administrative failures.

However, these compelling on-paper advantages are counterbalanced by significant operational risks and stakeholder conflicts that have emerged during implementation.

3.0 Risk Assessment: Navigating Project Headwinds and Controversies

Despite the project’s compelling advantages, investors must critically evaluate a range of significant risks rooted in stakeholder conflicts, financial viability, and policy execution. While designed for speed, the public-led model has encountered substantial friction on the ground.

Resident Opposition and Property Rights Conflicts The project’s reliance on eminent domain to acquire property creates a fundamental tension with the principle of private property rights, fueling intense local opposition. A protest banner in the Jemulpo district bluntly stated, “Annihilating commercial districts to fatten the belly of iH [Incheon Housing and City Development Corporation]. Immediately cancel the Jemulpo Complex Project!” In a more formal challenge, residents of Shin-gil 4, who had already achieved 75% consent for a private redevelopment, filed a lawsuit against the Minister of Land, Infrastructure and Transport for abuse of power after their area was designated a public project candidate site.

Compensation and Profitability Disputes The project’s compensation structure presents a fundamental valuation conflict for landowners. Appraisals are based on the “current value” of a property, which does not reflect the future development gains. This creates a perception that owners are being forced to relinquish their assets at a “cheap price.” This issue is compounded by the risk of ‘price inversion,’ where the value of the new apartment—capped by the pre-sale price ceiling (분양가상한제)—may not sufficiently exceed the value of the original property plus the owner’s required financial contribution.

The most acute and systemic threat to project viability is the variable of construction cost inflation, which directly impacts owner contribution calculations and undermines initial consent. This combines with the compensation structure to create a dangerous “profitability squeeze” for landowners. Escalating costs increase their required contribution (분담금), while compensation based on current value and a capped pre-sale price limit their potential upside. This squeeze is the primary driver of consent withdrawal and project failure.

Execution Risk and Public-Sector Credibility Project momentum has been challenged by significant execution risks. Of the 82 initial candidate sites, 33 were withdrawn due to a failure to secure the required resident consent, highlighting a major gap between government plans and community acceptance. The credibility of the primary implementing agency, LH, has also been a major headwind. A 2021 land speculation scandal involving its employees and a 2023 scandal related to construction defects (rebar omissions) have eroded public trust and fueled opposition from residents wary of the agency’s competence and integrity.

While these operational risks are significant, they were largely secondary to a single, paralyzing legal flaw that froze the market. Its recent amendment has not eliminated these operational risks, but has made them calculable for the first time.

4.0 The Game Changer: Deconstructing the ‘Rights Calculation Date’ Amendment

The “Rights Calculation Date” was the single most critical barrier to investment during the project’s initial phase. A rigid, retroactive rule effectively froze transactions and created widespread uncertainty. However, a recent legislative amendment, passed in late 2023, has fundamentally altered the risk-reward calculation for potential investors, unlocking new strategic possibilities.

Originally, the rule established a fixed cutoff date of June 29, 2021. Any individual who purchased property within a designated or future candidate site after this date would not be granted rights to a new apartment and would instead be subject to cash liquidation. This policy had a severely negative market impact, causing a transaction freeze in many aging neighborhoods and creating “unintentional victims”—buyers who had purchased homes for residential purposes without knowledge of future project designations.

In a landmark shift, the revised Public Housing Special Act scraps the fixed 2021 cutoff. The rights calculation date is now tied to the “individual candidate site announcement date.” This means eligibility for an apartment is determined by whether the property was acquired before the specific date on which that particular site was officially announced as a candidate.

This change creates clear investment eligibility scenarios, outlined below.

Investment Eligibility Scenarios Post-Legislation

| Scenario | Acquisition Timeline | Eligibility for Apartment Rights |

| Case 1: Acquiring in a Pre-Designated Site (e.g., Jeungsan 4) | Current acquisition | Cash Liquidation. The site was announced on March 31, 2021, a date that has already passed. |

| Case 2: Retroactive Eligibility (e.g., Siheung Daeya Station) | Acquisition in 2022 (after the old 2021 cutoff but before the Dec 2023 site announcement) | Apartment Rights Granted. The acquisition date predates the site’s official announcement date. |

| Case 3: Pre-emptive Investment in a Potential Site | Current acquisition in an unannounced but eligible area (e.g., an aging, station-adjacent area) | Apartment Rights Granted. If the site is designated in the future, the acquisition will have occurred before the announcement date. |

This critical legal clarification moves the goalposts from a punitive, retroactive date to a predictable, forward-looking standard, enabling a new investment strategy focused on the most promising project sites.

5.0 Analysis of Leading Project Sites

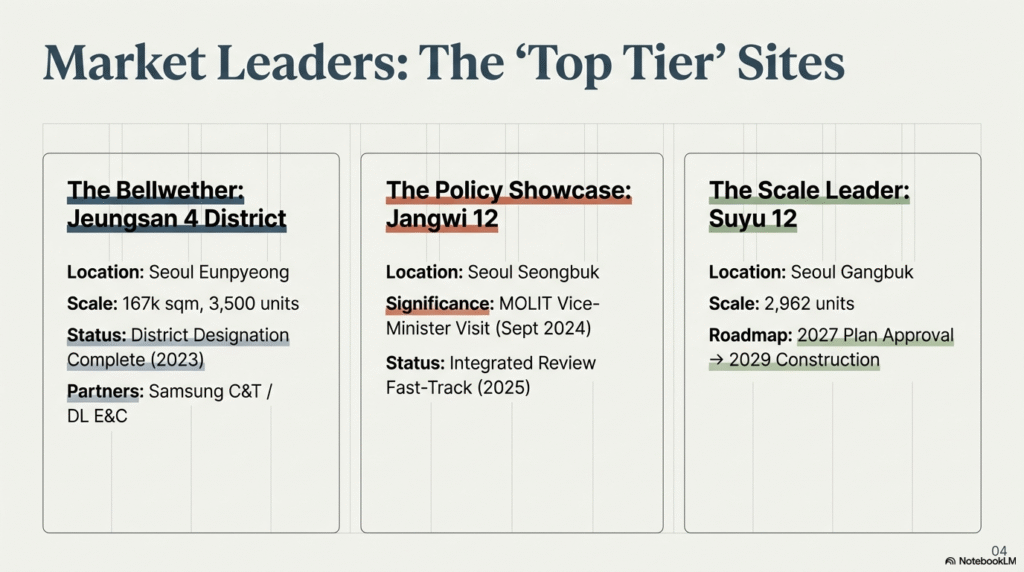

This section provides a comparative analysis of top-tier project sites that have demonstrated significant progress. The evaluation is based on their administrative status, government support, and resident consensus, which are key indicators of their probability of success.

5.2.1. Jeungsan 4 District (Eunpyeong-gu, Seoul)

- Profile: As the largest-scale flagship project, slated to deliver approximately 3,500 housing units, Jeungsan 4 serves as the symbolic barometer for the entire program.

- Progress & Status: The project has completed its official district designation, achieved a high resident agreement rate early on, and selected a premier construction consortium of DL E&C and Samsung C&T, signaling strong market confidence.

- Investment Viability: Very High. The exceptionally high initial consent rate de-risks the early stages and provides a strong mandate for the public entity (LH) to push through subsequent challenges. The project is receiving concentrated administrative support from a government determined to create a visible success story.

5.2.2. Jangwi 12 District (Seongbuk-gu, Seoul)

- Profile: A high-priority site located within the formerly-stalled Jangwi New Town, an area with high demand for redevelopment.

- Progress & Status: The district designation is complete, and the project is on the cusp of receiving project plan approval. The First Vice Minister’s recent site visit to ensure the smooth implementation of “Season 2” incentives underscores the high level of government focus.

- Investment Viability: Very High. The Vice Minister’s direct involvement is a political signal that provides “top-down administrative de-risking,” making it a high-probability candidate for expedited approvals—a critical factor in calculating project IRR (Internal Rate of Return).

5.2.3. Suyu 12 District (Gangbuk-gu, Seoul)

- Profile: A mega-project set to deliver 2,962 new homes, making it a key residential anchor in northern Seoul.

- Progress & Status: The project benefits from a clear, government-endorsed development timeline: integrated review and plan approval by 2027, with a target groundbreaking date of 2029.

- Investment Viability: High. The clarity of its official roadmap provides a strong degree of certainty and predictability for long-term investors seeking a stable project with a defined development horizon.

These leading sites represent the most advanced and institutionally supported projects in the portfolio, paving the way for a new phase of urban development.

6.0 Conclusion: Investment Strategy and Outlook

The Urban Public Housing Complex Project has evolved from a controversial, high-risk initiative into a more structured and legally transparent investment opportunity. The shift from a legal minefield, defined by the original “Rights Calculation Date,” to a rules-based opportunity has fundamentally reshaped the investment landscape, while the program’s extension to late 2026 provides the necessary runway for projects to advance.

For investors and developers navigating this environment, a clear strategy is essential.

Key Investment Directives

- Mandatory Date Verification: The first and most critical step for any investment is to confirm the target area’s “candidate site announcement date.” Acquiring property in an already-announced district carries the near-certain risk of cash liquidation rather than rights to a new apartment.

- Focus on ‘Top Tier’ Sites: Prioritize opportunities within leading districts like Jeungsan 4, Jangwi 12, and Suyu 12. These sites benefit from established momentum, high resident consensus, and strong political tailwinds, which significantly increase their probability of completion and mitigate execution risk.

- Evaluate Pre-emptive Opportunities: The legal amendment has created a new strategic avenue for pre-emptive investment. Acquiring property in aged, station-adjacent, low-rise residential areas that meet the project’s eligibility criteria but have not yet been announced as candidate sites is now a viable strategy for securing future apartment rights.

With major legal uncertainties resolved and enhanced incentives in place, the Urban Public Housing Complex Project is poised to become a significant channel for new housing supply in Seoul. For informed investors who understand the revised rules and focus on projects with demonstrable momentum, the program offers unique opportunities to participate in the next wave of Korean urban redevelopment.

| 지역 (구역명) | 승인 고시일 (지구지정 기준)※ 사업계획 승인 고시일 병기 | 무주택자 권리승계 기한(고시일로부터 6개월) | 공급 예정 규모 | 공공시행자 (주요 시공자) |

|---|---|---|---|---|

| 은평구 증산4구역 | 2021.12.31. (국토부 고시) | 2022.06.30. | 약 4,112세대 예정 | LH (컨소시엄 시공 예정) |

| 영등포구 신길2구역 | 2021.12.31. (국토부 고시) | 2022.06.30. | 약 1,326세대 예정 | LH |

| 도봉구 방학역 인근 | 2021.12.31. (국토부 고시) | 2022.06.30. | 약 409세대 예정 (→ 사업계획 승인 시 420세대 확정) | LH (두산건설 컨소시엄) |

| 은평구 연신내역 인근 | 2021.12.31. (국토부 고시) | 2022.06.30. | 약 427세대 예정 (→ 사업계획 승인 시 392세대 확정) | LH |

| 도봉구 쌍문역 동측 | 2021.12.31. (국토부 고시) | 2022.06.30. | 약 646세대 예정 (→ 사업계획 승인 시 639세대 확정) | LH (두산건설 컨소시엄) |

| 도봉구 쌍문역 서측 | 2021.12.31. (국토부 고시) | 2022.06.30. | 약 1,088세대 예정 (→ 사업계획 승인 고시 2024.12.30., 1,404세대 확정) | LH |

| 중랑구 사가정역 인근 | 2023.12.08. (국토부 고시) | 2024.06.08. | 약 1,300세대 예정 | LH |

| 중랑구 용마터널 인근 | 2023.12.08. (국토부 고시) | 2024.06.08. | 약 551세대 예정 (→ 사업계획 승인 고시 2025.12.26., 551세대 확정) | LH |

| 성북구 장위12구역 | 2025.03.19. (국토부 고시) | 2025.09.19. | 1,386세대 예정 | LH |

| 강북구 수유12구역 | 2025.08.01. (국토부 고시) | 2026.02.01. | 2,962세대 예정 | LH |

| 중랑구 상봉역 인근 | 2025.10.31. (국토부 고시) | 2026.04.30. | 781세대 예정 | LH |

| 중랑구 용마산역 인근 | 2025.10.31. (국토부 고시) | 2026.04.30. | 783세대 예정 | LH |

| 도봉구 창2동 주민센터 일대 | 2025.10.31. (국토부 고시) | 2026.04.30. | 584세대 예정 | LH |

| 은평구 불광동 329-32 일대 | 2025.11.28. (국토부 고시) | 2026.05.28. | 1,670세대 예정 | LH |

| 강동구 고덕역 인근 | 2025.11.28. (국토부 고시) | 2026.05.28. | 2,486세대 예정 | LH |

| 영등포구 영등포역 남측 일대 | 2025.12.26 (국토부 고시) | 2026.06 | 3,366세대 예정 | LH |