Introduction: A Practical Guide for Investors

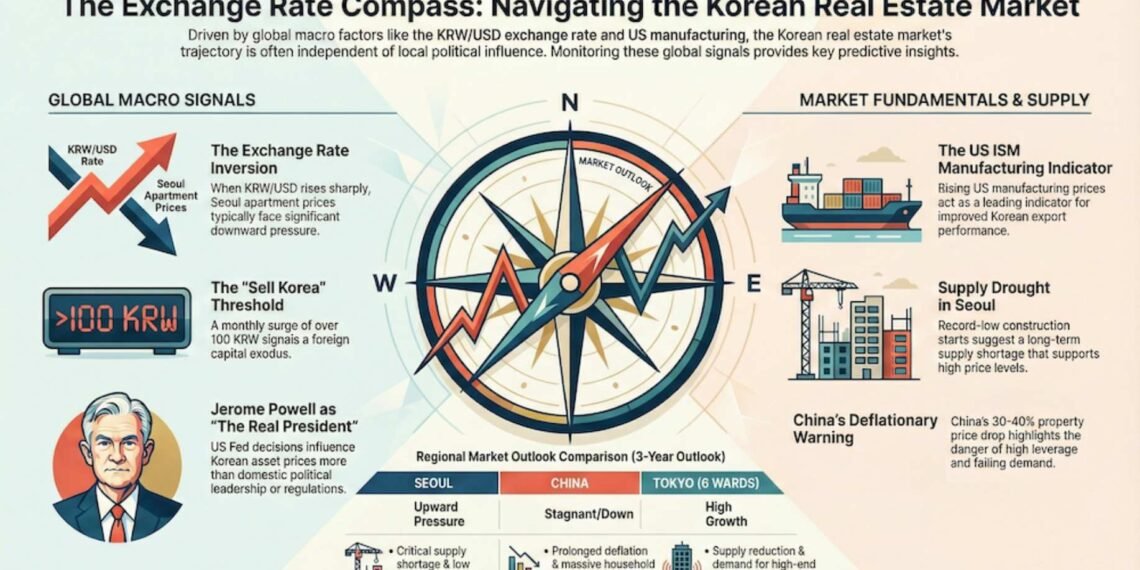

Seasoned investors understand that the real drivers of the Korean market are not found in the daily theater of domestic politics, but in the powerful undercurrents of the global economy. While others are distracted by noise, a disciplined focus on a few decisive international signals provides an unassailable analytical edge. This guide cuts through the complexity to focus on the only indicators that truly matter: the Won/Dollar exchange rate, the U.S. ISM manufacturing index, and copper prices. Understanding these signals reveals a clear thesis: a powerful export cycle fueled by U.S. demand is creating immense wealth in Korea, while deflationary forces from China are suppressing interest rates—creating a near-perfect environment for the Seoul property market.

——————————————————————————–

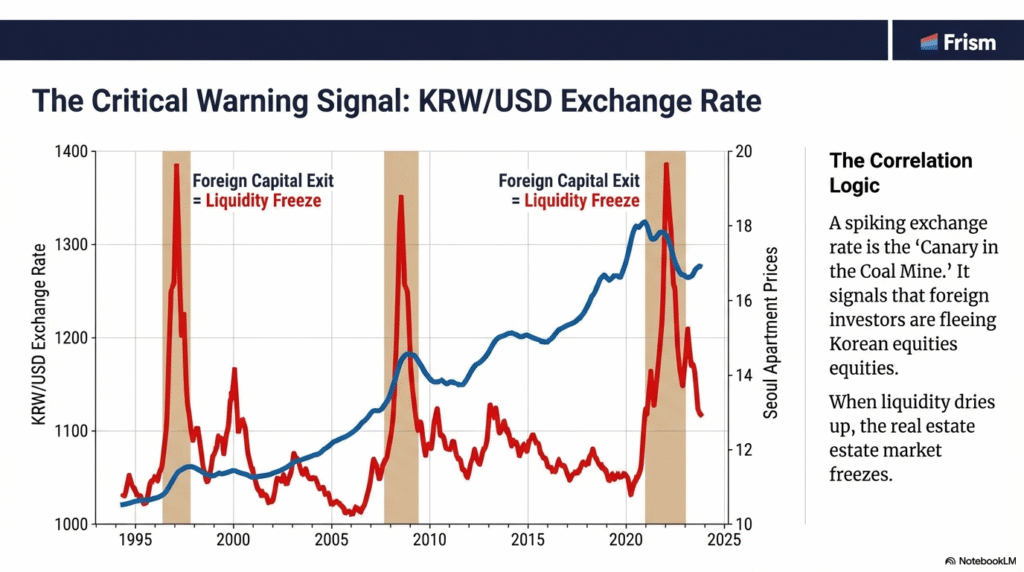

1. The Single Most Important Signal: The Won/Dollar Exchange Rate

If an investor could monitor only one metric, it should be the Won/Dollar exchange rate. The rule is ironclad and has held for decades: the Korean real estate market cannot withstand periods when the exchange rate rises sharply, such as by 100 won or more within a single month. A rapidly rising exchange rate is a critical warning sign for two fundamental reasons:

- Foreign Capital Outflow: A rising Won/Dollar rate is a direct signal that foreign investors are executing a “Sell Korea” strategy. Foreigners hold approximately one-third of Korea’s 3,000 trillion won stock market. When they sell en masse, they liquidate Korean assets and convert won back to dollars, causing the exchange rate to spike. This mass selling collapses the financial markets, which starves the property market of its primary source of fresh capital.

- Extreme Negative Sentiment: A sudden surge in the exchange rate reveals that global investors believe the “world is ending,” even if they are ultimately wrong. This powerful wave of pessimism, born in the stock market, inevitably spills over and poisons the psychology of the real estate market.

For the disciplined investor, the directive is clear. A steadily falling or stable exchange rate is a green light for investment. A rising rate is a non-negotiable command: stop, and protect capital. The movement of this foreign capital is inextricably linked to the health of the world’s largest economy, which brings us to our next indicator.

——————————————————————————–

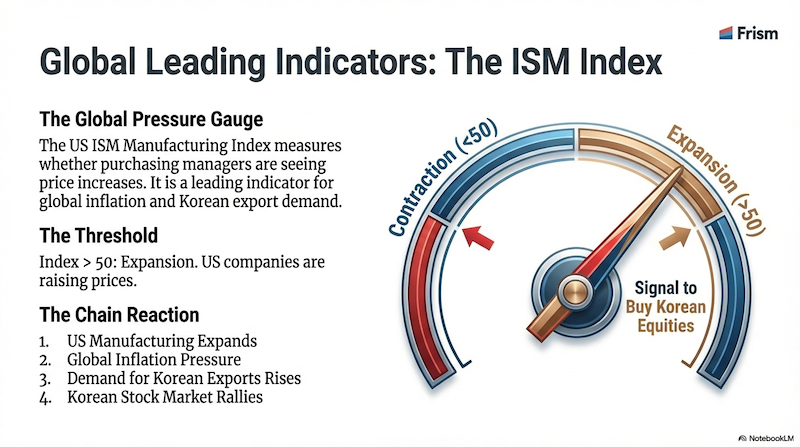

2. The Engine of Demand: The U.S. ISM Manufacturing Index

The Institute for Supply Management (ISM) Manufacturing Index is a monthly survey of purchasing managers at America’s top 400 manufacturing firms. It is a direct measure of the health of the U.S. manufacturing sector and a crucial leading indicator for inflation. For Korea, its impact unfolds in a clear, three-step chain reaction:

- U.S. Demand Rises: When the ISM index climbs above 50, it signifies that a majority of U.S. companies are raising prices in response to a healthy economy and strong demand.

- Korean Exports Benefit: As Korea’s corporations largely function as “subcontractors” to the U.S. economic machine, this strength translates directly into increased orders and better pricing power for Korean exports.

- Corporate Profits and Wages Grow: The export boom fuels record-breaking corporate profits and, subsequently, higher wages and bonuses for workers at major companies. This new wealth provides the firepower for domestic asset markets.

However, a rising ISM index can lead to two profoundly different outcomes, depending on its inflationary impact.

| Scenario | Description | Implication for Korea |

| Moderate Inflation | U.S. companies raise prices, but overall consumer inflation remains stable and low, as was the case in 2017-2018. | A “Great” and sustained period for investment and long-term asset price growth. |

| Rapid Inflation | U.S. companies raise prices, and these hikes quickly translate into high consumer inflation (e.g., 10%), as seen in 2022. | A short and brutal boom is inevitably followed by a market crash (“hell”). |

The price of finished goods is tied to the cost of their raw materials. This brings us to the next essential barometer for Korea’s export economy: copper.

——————————————————————————–

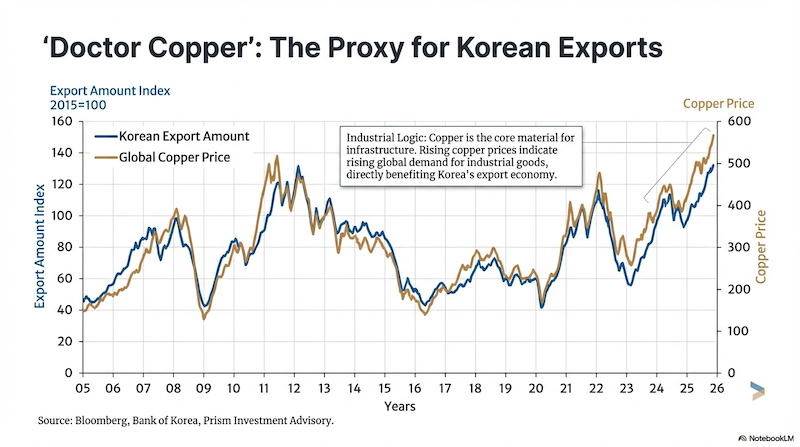

3. The Barometer for Exports: Copper Prices

The price of copper has a direct and powerful correlation with the price of Korean exports, particularly high-value semiconductors. The relationship is so consistent it can be stated as a simple rule:

“When copper prices rise, Korean export price indices rise. When copper prices fall, Korean export price indices fall.”

Monitoring copper prices provides a real-time view into the profitability of Korea’s entire export-driven economy. This dynamic is why corporate profits are forecast to grow from 240 trillion won last year—itself an all-time record high—to an even greater 280 trillion won this year.

While strong U.S. demand creates inflationary pressure, a powerful deflationary force is simultaneously at work in the global economy: China.

——————————————————————————–

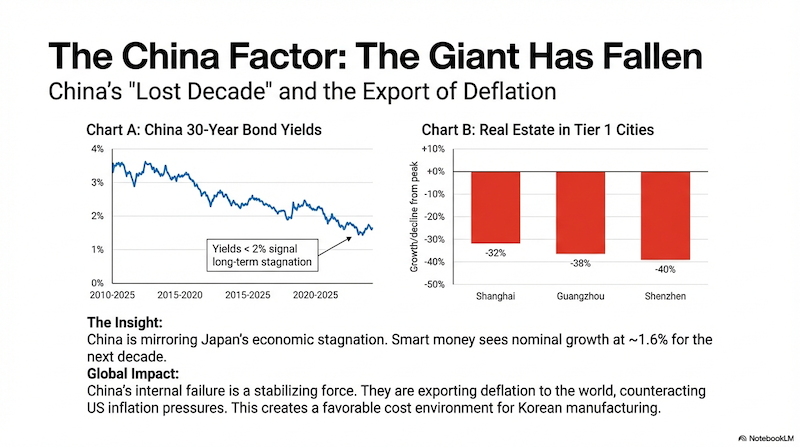

4. The Counterweight: China’s Economic Decline

While a strong U.S. economy creates inflationary pressure, China’s concurrent economic collapse provides a critical deflationary counterweight, creating a “Goldilocks” environment for Korean assets. China’s severe decline and deflation help moderate global inflation, making the “Rapid Inflation -> Crash” scenario far less likely for now. The evidence of this collapse is undeniable:

- Record-Low Interest Rates: China’s 10-year government bond yield is around 1.6%—a rate lower than Japan’s. This signals that the most sophisticated capital in China expects near-zero growth for the foreseeable future.

- Prolonged Property Crash: Real estate prices in tier-one cities like Shanghai, Shenzhen, and Hangzhou have collapsed by 30-40% over the past three years, devastating household wealth.

- Capital Flight: The 2022 Shanghai lockdown was a political turning point. It shattered the confidence of wealthy Chinese citizens, prompting a massive and ongoing exodus of capital from the country.

Ultimately, China’s bust helps suppress global inflation, favoring the “moderate inflation” scenario that is most beneficial for the Korean economy and its asset markets.

——————————————————————————–

5. Conclusion: Tying It All to the Korean Real Estate Market

The current economic landscape is defined by a rare and powerful confluence of factors. A robust export cycle, driven by U.S. demand, is generating record corporate profits and wage growth. Simultaneously, low import prices and deflationary pressure from China are keeping domestic inflation and interest rates suppressed.

In this environment, what could possibly stop the rise of the real estate market?

Only an extreme government intervention—such as a total freeze on private lending—could halt the current momentum, an action that is politically untenable. The underlying domestic fundamentals for real estate, particularly in Seoul, remain incredibly strong:

- Favorable Interest Rates: With inflation stable, the Bank of Korea has room to lower interest rates, which provides direct fuel for property prices.

- Severe Supply Shortage (Seoul): Housing starts (착공) are at historic lows, guaranteeing a severe lack of new apartment supply in Seoul for at least the next three years. Critically, unlike the last major downturn which was worsened by a massive supply glut from “2nd-phase new towns” and “Bogeumjari” projects, no such supply overhang exists today.

- Explosive Income Growth: Record corporate profits are not remaining on balance sheets. Unions at SK Hynix, Samsung Electronics, and Hyundai Motor are extracting massive pay raises and bonuses for their employees. This direct transfer of wealth is providing the financial firepower necessary to sustain the property market’s rise.

While the fundamentals for the next 6-12 months appear exceptionally strong, the extreme price divergence between the Seoul market and the rest of the country presents a long-term risk. Prudent investors will continue to monitor these global indicators, as they—not domestic headlines—will signal the next major shift in the market.

Based on the comparison between Dr. Hong Chun-wook's lecture (mid-2025) and the market conditions in January 2026 described in your sources, Dr. Hong was right about the Seoul housing market but appears to have been wrong about the Korean stock market's performance, though his warning about the exchange rate was prescient.

Here is the detailed breakdown:1. Housing Market: Dr. Hong was RIGHT

Dr. Hong predicted a short-term bullish run for Seoul real estate driven by a “supply cliff,” despite arguing that it was in bubble territory. The 2026 data strongly confirms this prediction.

- Prediction: Dr. Hong argued that Seoul prices would rise because “there is no supply” and housing starts had collapsed three years prior,,. He advised that despite high prices, the market would remain strong in the short term.

- Outcome (Jan 2026):

- Seoul apartment prices have risen for 48 consecutive weeks as of January 2026.

- The market is described as “overheating” and a “runaway housing market,” with gains “well above expectations”,.

- The “supply cliff” thesis is validated by DWS research, which notes that supply remains tight in core districts like Gangnam and Yeouido, supporting rental growth.

- The affordability crisis he warned of has materialized, with young Koreans giving up on homeownership because it takes 13.9 years of entire disposable income to afford a home.

2. Stock Market: Dr. Hong was WRONG (on Timing and Performance)

Dr. Hong adopted a defensive stance on Korean stocks in mid-2025, selling most of his holdings. However, the market subsequently experienced a historic rally.

- Prediction: Dr. Hong stated he sold his stocks in late June 2025 because the exchange rate was rising, which he viewed as a signal that “foreigners are selling” and the market would struggle,. He called Korean stocks unpredictable and suggested land or US stocks instead.

- Outcome (Jan 2026):

- Contrary to his bearish exit, the KOSPI index surged, rising 68% in 2025, making it a “top performer among the world’s largest markets”.

- Domestic investors (retail “ants”) drove this rally using borrowed money, which hit an all-time high of 26.8 trillion won, essentially filling the void left by foreigners or institutions.

- By selling in June 2025, Dr. Hong missed a massive rally driven by a “frenzy among retail investors” and an AI/semiconductor boom,.

3. Exchange Rate: Dr. Hong was RIGHT (on the Indicator) but WRONG (on its Impact)

Dr. Hong correctly identified that the Won would weaken, but the traditional correlation between a weak Won and a crashing stock market broke down due to domestic retail behavior.

- Prediction: He warned that if the exchange rate rises (weak Won), it indicates a crisis and assets should be sold,. He feared the rate rising above the 1,300–1,400 range.

- Outcome (Jan 2026):

- The exchange rate did surge significantly, reaching the 1,470–1,480 won range in January 2026,.

- The Bank of Korea Governor admitted this level is “substantially misaligned with our economic fundamentals”.

- The Disconnect: While Dr. Hong correctly predicted the currency instability, he failed to foresee that domestic retail investors (the “Seohak ants” and domestic buyers) would prop up the stock market despite the weak Won,.

4. Strategic Advice (Japan/US): VALIDATED

Dr. Hong’s advice to diversify away from Korea into US stocks or Japanese real estate aligns with the major trends of 2026.

- Japan: He advised buying Tokyo real estate. DWS research confirms that Japan remains a top investment magnet in APAC, ahead of Korea.

- US Stocks: He advocated for US assets. By 2026, Koreans held a record $1.2 trillion in overseas securities, following the exact strategy he recommended. The government is even encouraging young people to buy equities to move away from the overheating housing market.

Summary Verdict

Dr. Hong correctly analyzed the macroeconomic mechanics (supply shortage in housing, currency weakness). However, he underestimated the behavioral factor of Korean retail investors, who drove the stock market to record highs despite the poor macroeconomic signals (weak Won) that caused Dr. Hong to exit the market. He was spot-on regarding the Seoul real estate squeeze.