Introduction

This report provides a comprehensive analysis of the primary international and domestic macroeconomic factors projected to influence the South Korean housing market in 2026. The confluence of diverging global economic policies, unique domestic capital flows, and persistent local supply constraints creates a complex but navigable landscape. This analysis is intended to inform strategic investment and policy decisions by outlining the key pressures and likely outcomes for the market through 2026.

1.0 The Global Macroeconomic Landscape: A Tale of Two Economies

The global economic context for 2026 is defined by a sharp divergence between the economic trajectories of the United States and China. The U.S. is experiencing a sustained, investment-led boom, while China is grappling with a severe deflationary crisis. This bifurcation creates a complex and often contradictory set of external pressures on the South Korean economy, influencing everything from its currency value to its monetary policy.

Key Drivers of the 2026 U.S. Economic Outlook

The American economy is projected to maintain strong momentum through 2026, driven by a powerful combination of fiscal stimulus, private investment, and anticipated monetary easing.

- Robust Manufacturing Investment: Policy initiatives like the Inflation Reduction Act (IRA) have successfully incentivized significant foreign direct investment, sparking a manufacturing investment boom. A prime example is TSMC’s $65 billion investment in Arizona, supported by $6.6 billion in government subsidies. While the pace of new investment may moderate, the economic benefits from projects already underway will continue to be felt.

- Sustained Fiscal Stimulus: Expansive fiscal policies from the Biden administration, coupled with significant tax cuts enacted during the Trump administration, such as those under the policy framework referred to as OBBBA in the source analysis, continue to fuel the economy. These measures have particularly boosted consumption among affluent households, sustaining strong domestic demand.

- Aggressive AI-Related Corporate Investment: A powerful, innovation-driven growth cycle is being propelled by massive corporate investment in Artificial Intelligence. Major technology firms like Meta, OpenAI, and Tesla are taking on high-cost debt (at rates exceeding 6%) to fund large-scale initiatives, signaling deep confidence in future returns and locking in a high-growth trajectory for the sector.

- Anticipated Monetary Easing: The U.S. Federal Reserve is expected to pursue an aggressive series of interest rate cuts through 2026. This outlook is driven by anticipated political pressure from the Trump administration and the end of Fed Chair Jerome Powell’s term in May 2026. Projections indicate that the U.S. policy rate could fall to the low 2% range by the end of 2026.

China’s Deflationary Economic Crisis

In stark contrast to the U.S., China is mired in a systemic deflationary crisis with far-reaching consequences for the global economy.

- Real Estate Sector Collapse: The government’s “common prosperity” policy triggered a collapse in the property market, leading to a severe contraction in domestic demand. Bank lending to the construction sector has fallen back to 2012 levels, leading to a cascade of defaults.

- Pervasive Deflationary Pressures: Widespread austerity among both households and corporations has entrenched a deflationary mindset. With the prices of goods from wine to automobiles falling, consumers are increasingly delaying purchases in anticipation of even lower prices, creating a vicious cycle of contracting demand.

- Eroding Corporate Profitability: Corporate earnings have collapsed, with government subsidies serving as the only remaining support. The situation has become so dire that an editorial in the People’s Daily has publicly called for an end to “ruinous competition” among firms struggling for survival.

- Counterintuitive Currency Strength: Critically, China has allowed the Yuan to remain strong relative to the currencies of key competitors like the South Korean Won and the Japanese Yen. This policy exacerbates the crisis by weakening the competitiveness of Chinese exports while simultaneously lowering the cost of imports, effectively exporting its deflationary pressures to other nations.

These powerful and opposing global forces create the turbulent external environment within which the South Korean economy must operate.

2.0 South Korea’s Domestic Economic Environment

While global trends provide the essential backdrop, South Korea’s unique internal dynamics—from unprecedented capital flows to significant monetary policy constraints—will ultimately determine the specific outcomes for its housing market. Understanding these domestic factors is critical to forming an accurate 2026 outlook.

Currency and Capital Outflows

South Korea is experiencing a paradoxical situation where the Korean Won remains weak despite a surging stock market (KOSPI projected to break 4,000) and record-high corporate profits. This weakness is a direct result of a powerful boom in outbound retail investment, with Korean investors sending over $30 billion per quarter abroad to participate in the very U.S. AI investment cycle detailed previously. This trend is structurally reinforced by South Korea’s world-low corporate dividend payout ratio; even with a record-setting market, the dividend yield is expected to be only around the 25-year average (1.6%), providing a strong incentive for capital to seek higher returns overseas.

Sectoral Economic Divergence

The domestic economy is sharply divided. The export-oriented semiconductor sector is poised to continue breaking performance records, benefiting from a combination of rising legacy memory prices and the weak Won. However, the domestic-facing economy remains sluggish and is not participating in this boom.

Subdued Inflation and Monetary Policy Constraints

Despite the high exchange rate, which would typically drive up import prices, domestic inflation remains low. This is a consequence of the weak internal economy and low global oil prices. This environment creates a difficult situation for the Bank of Korea. Faced with concerns over a potential real estate bubble, yet seeing no strong inflationary pressure, the central bank has little justification or ability to pursue further interest rate cuts.

These specific domestic economic conditions create the unique foundation upon which the 2026 housing market will perform.

3.0 Direct Impacts on the South Korean Housing Market

The global and domestic macroeconomic factors previously discussed do not remain abstract forces; they translate into specific and measurable pressures on housing prices, supply, and demand. This section analyzes how these dynamics will directly shape the South Korean housing market in 2026.

Macroeconomic Indicators and Housing Price Stability

Historical data reveals a clear pattern for housing price behavior. An analysis of the relationship between U.S. interest rates, the KRW/USD exchange rate, and Seoul apartment prices shows that a market crash has historically required the simultaneous occurrence of two conditions: a surging exchange rate (weakening Won) and rising U.S. long-term interest rates.

The 2026 forecast projects the exact opposite scenario. With the U.S. Federal Reserve expected to pursue aggressive rate cuts, a key prerequisite for a housing price crash is absent, making such an event highly unlikely. Lower interest rates are instead expected to support housing prices through several mechanisms:

- Reduced opportunity cost of ownership as interest income from bank deposits falls.

- Increased market liquidity as borrowing becomes cheaper.

- Rising inflation expectations, spurring investment in real assets to hedge against a real loss of purchasing power.

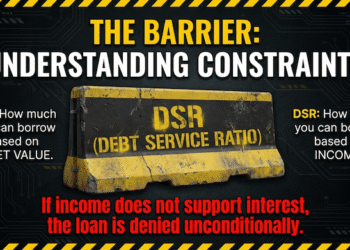

The Critical Role of the Housing Supply Deficit

A severe and persistent lack of new housing supply acts as a powerful floor under market prices. This deficit is the result of multiple compounding factors.

- Chronic Supply Shortage: The market has been grappling with a chronic shortage of new housing supply since 2021, and there is no near-term resolution in sight.

- Ineffective Government Policy: The government’s ‘Housing Supply Expansion Plan,’ announced in September 2025, has proven insufficient to address the problem. By 2026, only 7,000 units from the 3rd New Town projects are scheduled for sale, with no units at all from key high-demand areas like Hanam Gyosan.

- Lessons from International Markets: A parallel situation in Tokyo demonstrates the risk. In Japan’s capital, a slowdown in the construction of popular tower mansions has exacerbated price and rent increases, highlighting how supply constraints in desirable areas can override broader economic weakness.

The Investment Landscape: Regulation and Economic Inequality

The current economic recovery is not evenly distributed. As in the United States, South Korea is experiencing a K-shaped recovery where income growth is heavily concentrated among the employees and shareholders of large, export-oriented corporations, particularly those in the record-breaking semiconductor sector. This dynamic has profound implications for the housing market.

This concentration of wealth and income growth makes a broad, nationwide housing boom improbable. Instead, demand is focused on specific, high-income areas, suggesting that price appreciation will be highly localized rather than widespread.

These combined factors—accommodative monetary policy, a severe supply deficit, and concentrated income growth—point toward a highly segmented market with distinct strategic implications for investors and policymakers.

4.0 2026 Market Outlook and Strategic Implications

Synthesizing the global and domestic analysis, the 2026 South Korean housing market is not poised for a crash. The combination of an accommodative U.S. monetary policy, persistent domestic supply shortages, and a structurally weak Korean Won provides a strong foundation for price stability and targeted growth. The primary risk is not a market-wide collapse but rather a further segmentation of the market driven by a K-shaped economic recovery. Therefore, strategies must pivot from anticipating broad market lifts to identifying pockets of policy-driven value.

Investment Thesis for a Segmented Market

Given this outlook, an investment strategy based on a widespread “balloon effect” or generalized price gains is unlikely to succeed. Instead, the most viable approach is to focus on properties that align with both market fundamentals and likely future policy direction.

The most promising investment targets are old, high-density apartment complexes in prime locations with high redevelopment potential. The rationale for this conclusion is rooted in the government’s pressing need to solve the urban housing supply crisis. Even if current redevelopment calculations do not appear profitable, the government will ultimately be compelled to provide preferential treatment and financial incentives to these types of properties to unlock new supply. The long-running case of the ‘Eunma Apartments’ redevelopment serves as a key example of how policy will eventually bend to favor such strategically vital projects.